ESG Policies and Regulations Update December 2023

The following details framework updates that occurred in December, as well as highlighting some key updates and releases to be aware of in the coming few years. Frameworks such as those explored in this report can help stakeholders understand how an organisation manages risks and opportunities around such sustainability issues. Often used as a communication tool, it can play an important role in demonstrating the sincerity of a company’s actions as well as ensuring good governance.

The global regulatory landscape has experienced exponential growth in the past few decades, with 647% increase in ESG regulations since the start of the 21st century. In June, global ESG regulations were found to have increased by 155% in the last 10 years. 1,255 ESG regulations have been introduced worldwide since 2011 yet to compare, only 493 regulations were published in the 9 years from 2001 to 2010.

Furthermore, four in ten British businesses believe sustainability to be profitable, according to a study conducted by SAP. 37% of 300 UK-based business leaders have stated they are therefore motivated to act on environmental sustainability as they see opportunities to boost financial performance.

December 2023 Update

The general observed trends within frameworks include a growing focus on disclosure, regarding both data and strategy, as well as an increased engagement of supply chains. Climate impacts are also seeing greater levels of inclusion into regulations and policies.

| Framework | Update | Date |

|---|---|---|

| HREDD | UK has introduced the Commercial Organisations and Public Authorities Duty (Human Rights and Environment) Bill. | 1 Dec 2023 |

| SBTi | The SBTi has launched a call to action for engagement with supply chains to catalyse ambitious corporate climate action, to mark the start of COP28. | 1 Dec 2023 |

| SFDR | European Supervisory Authorities have published their Final Report amending the draft Regulatory Technical Standards (RTS) | 4 Dec 2023 |

| EFRAG | EFRAG release a draft ESRS-GRI Interoperability Index | 12 Dec 2023 |

| CSDDD | Informal agreement: a mixed bag on financial sector requirements | 14 Dec 2023 |

| ISSB | New and updated resources to held companies apply IFRS S1 and S2 | 14 Dec 2023 |

| TPT | Transition planning guidelines for sector specifics have been released | 18 Dec 2023 |

| ISSB | ISSB publishes targeted amendments to enhance the international applicability of SASB targets | 20 Dec 2023 |

Implications

Human Rights and Environmental Due Diligence (HREDD)

The UK has introduced the Commercial Organisations and Public Authorities Duty Bill. The introduction of HREDD, which stands for Human Rights and Environmental Due Diligence, has proposed to be mandated in the UK. This would necessitate commercial organisations to prevent human rights and environmental harms in their operations and supply chains, emphasising stakeholder engagement.

The bill aligns with global standards, and companies have been advised to prepare for potential legal requirements. Annual reporting would be required for companies surpassing a turnover threshold. The bill also provides guidance on tailoring HREDD to an organisation’s specifics, emphasising integration into policies and public reporting.

The Science-Based Target initiative (SBTi)

The SBTi is a global body enabling businesses to set ambitious emissions reductions targets in line with the latest climate science.

The private sector must decarbonise the entire value chain, including scope 3 emissions. These are often challenging for organisations when working towards science-based targets. By engaging supply chains to set science-based targets, companies can make considerable progress towards addressing their scope 3 emissions. This only represents a call to action, but provides a future direction for organisations annual reporting.

Sustainable Finance Disclosure Regulation (SFDR)

The SFDR, effective since March 2021, mandates financial market participants and advisers to disclose sustainability integration at both entity and product levels. It sets out rules on sustainability transparency, with a particular focus on preventing greenwashing.

The final report of the Regulatory Technical Standards proposes new climate and social reporting metrics, including greenhouse gas reduction targets and mandatory social metrics. These metrics include inadequate wages and exposure to tobacco cultivation and production.

European Financial Reporting Advisory Group (EFRAG)

EFRAG, the European Financial Reporting Advisory Group, have announced the release of a draft ESRS-GRI Interoperability Index, which is a mapping tool which will help companies identify the ‘commonalities between ESRS and GRI Standards’. This will also reduce the corporate reporting burden. The mapping creates a connection between the paragraph-level ESRS disclosure requirements and their corresponding GRI disclosures and requirements.

Corporate Sustainability Due Diligence Directive (CSDDD)

The CSDDD enforces a due diligence duty on in-scope companies operating in Europe to help ensure that they are contributing to sustainable development and the sustainable transition of economies. The aim is to harmonise rules at the EU-level and to create a level playing field between EU companies.

The CSDDD has reached an informal agreement, with the finalised text yet to be published. DigitalEurope and the RBA have prepared points where are thought to make it into the final document; the following is not exhaustive of the prepared points.

- Applicability scope: Large EU companies with 500 staff and net worldwide turnover of €150 million (non EU firms is €300m net turnover generated in the EU). Lower staff threshold for high risk firms.

- Value v supply chain: It seems that value chains (including end use and sale of products) isn’t included.

- Comes in to force 3 years from the entry into force of the directive.

International Sustainability Standards Board (ISSB)

The ISSB is a comprehensive global baseline for high-quality Sustainability Disclosure Standards to meet investor demands for transparent, reliable, sustainability reporting and will contribute to addressing greenwash.

Ahead of the ISSB Standards coming into effect from January 2024, new and updated resources to help companies apply the Standards have been released. The Standards are IRS S1 (sustainability-related financial disclosures) and IFRS S2 (climate-related disclosures). These resources are likely to be relevant for UK entities, as the UK SDS is expected to be endorsed by July 2024, whereby the ISSB’s Standards may be transposed into UK law.

The ISSB published amendments to the SASB Standards to enhance their international applicability. These amendments have removed and replaced jurisdiction-specific references and definitions, without substantially altering industries, topics or metrics.

Transition Plan Taskforce (TPT)

The TPT aims to help organisations to meet their climate goals and support the UK government’s pledge to achieve net zero by 2050.

The TPT has launched sector-specific guidance, which is intended to help businesses in seven sectors – asset managers, asset owners, banks, electric utilities and power generators, food and beverage, metals and mining and oil and gas. This guidance is to apply the TPT’s ‘gold-standard’ disclosure framework which was released in October.

COP28 conclusion

COP28 concluded on 12 December; a summary of the summit can be found on Acclaro’s website, here.

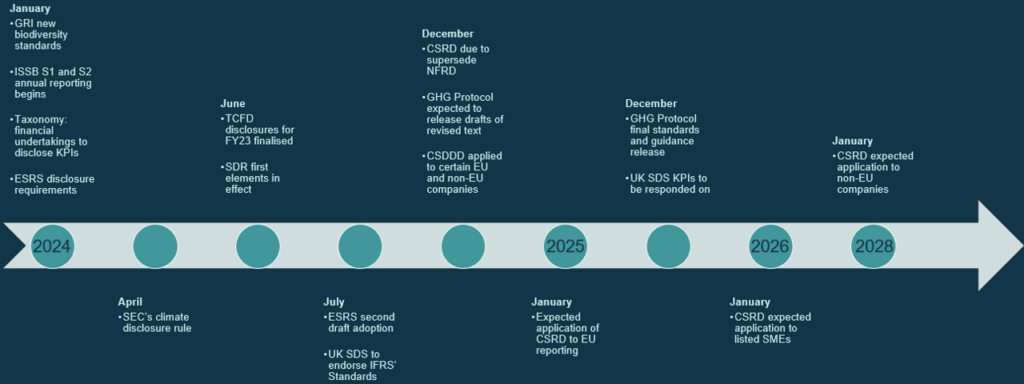

Upcoming Changes

| Date expected | Framework | Description |

|---|---|---|

| January 2024 | GRI | New GRI Biodiversity Standards expected |

| January 2024 | ISSB | IFRS S1 and IFRS S2 annual reporting begins |

| January 2024 | Taxonomy | Financial undertakings are required to disclose KPIs and other specified information |

| January 2024 | ESRS | Mandatory disclosure requirements under CSRD coming into effect |

| June 2024 | TCFD | FCA ESG Rules: TCFD disclosures relating to Financial Year 2023 to be finalised |

| June 2024 | SDR | First elements of the new rules (excluding anti-greenwashing rule) to come into force – at the earliest |

| July 2024 | ESRS | Anticipated adoption of the second draft of ESRS |

| July 2024 | UK SDS | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SDS |

| 2024 | CSRD | Due to supersede NFRD in 2024. Large companies already subject to NFRD must begin reporting on the fiscal year 2024 |

| 2024 | CSDDD | Application of CSDDD to certain EU and non-EU companies expected to begin at some stage in 2024 |

| 2024 | GHG Protocol | Expected to release drafts of revised text |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

How we can help

We can support you and your organisation navigate the complexities of voluntary and mandatory reporting, as well as the regulatory frameworks around sustainability. Please contact us to speak to one of our experts.

Abbreviations

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESRS – European Sustainability Reporting Standards

GHG Protocol – Greenhouse Gas Protocol

GRI – Global Reporting Initiative

HREDD – Human Rights and Environmental Due Diligence

ISSB – International Sustainability Standards Board

NFRD – Non Financial Reporting Directive

SBTi – Science Based Target initiative

SFDR – Sustainable Finance Disclosure Regulation

TCFD – Taskforce for Climate Related Disclosure

TPT – Transition Plan Taskforce

UK SDS – Sustainability Disclosure Standards