ESG Policies and Regulations Update September 2024

Keeping pace with net zero policies and regulation changes can pose a challenge. Our monthly updates are designed to provide you with the necessary support and guidance through the intricate landscape of ESG policies. We deliver the latest updates and significant developments concerning key sustainability frameworks, regulations, and standards from across the UK, EU, and US. We also delve into further detail on what you need to know.

This month’s edition explores the UK Government’s proposed consultation on Voluntary Carbon Markets and the Financial Conduct Authority’s extension for compliance with the UK’s sustainable fund naming and marketing regulations. We also examine MSCI’s new Carbon Project Ratings, aimed at enhancing transparency around high- and low-quality carbon credits, and introduce the newly launched Taskforce on Inequality and Social-related Financial Disclosures (TISFD).

September update

| Framework | Update |

|---|---|

| UK Legislation | UK Government to Launch Consultation on Voluntary Carbon Markets (VCM). |

| EU Legislation | EFRAG plans to release transition plan guidance in Q2 2025. |

| Financial Disclosure Frameworks | IIGCC publishes new guidance to help investors measure and reduce Scope 3 emissions. FCA SDR extends the deadline for compliance with the UK’s sustainable fund naming and marketing rules. The deadline for the Financial Institutions Net Zero (FINZ) Standard public consultation and the feedback period for the Scope 3 Discussion Paper have been extended. Climate Bonds Initiative (CBI) launches resilience and adaptation taxonomy. GFANZ to Release Guidance on Developing ‘Transition-Informed’ Indexes. |

| Voluntary Disclosure Framework | CDP publishes guidance on Corporate Sustainability Due Diligence Directive. MSCI Introduces Carbon Project Ratings. TISFD has officially launched. TISFD and EFRAG partner on social disclosures. IFRS Foundation releases Guidance to Help Companies Voluntarily Adopt ISSB Sustainability Reporting Standards. Assessing Transition Plans Collective (ATPC) has published new guidance for assessing net-zero transition plan credibility. |

Subscribe to newsletter

Receive our regulatory updates along with relevant news and insights in our monthly newsletters

Key Insights

UK Legislation

UK Government to Launch Consultation on Voluntary Carbon Markets (VCM)

The UK Government has announced plans to consult on reforms aimed at strengthening the Voluntary Carbon Markets (VCM) and emerging nature markets.

While specific details of the consultation have not yet been confirmed, Climate Minister Kerry McCarthy has indicated that the government is focused on establishing rules to address concerns over low-integrity carbon credit projects and to encourage greater investment in the sector.

The proposals are expected to be well-received by VCM operators and those in related biodiversity offset markets, who have been seeking clearer guidance from the government on how to drive investment in carbon removal projects—key to achieving long-term net-zero goals.

There has been growing demand from stakeholders in the VCM for regulatory reforms that enhance market integrity and attract increased investment. Proposed changes may include stricter regulations for carbon credit projects, better integration between the VCM and regulated carbon markets like the UK’s Emissions Trading Scheme (ETS), and more defined rules for corporate net-zero transition plans.

EU Legislation

EFRAG plans to release transition plan guidance in Q2 2025

EFRAG is set to release its transition plan implementation guidance for public feedback in January 2025, with a final version expected in Q2. This timeline extends the original deadline, which aimed to publish the final guidance by the end of the year.

Initially announced in April, the guidance is intended to assist companies reporting under the European Sustainability Reporting Standards (ESRS) with their transition plan disclosures. It will also clarify certain elements of the standards to encourage greater transparency.

The first draft of the guidance is expected to be completed by October 2024 and will be discussed in a public meeting of the Sustainability Reporting Technical Expert Group (TEG). Following discussions with both the TEG and the EFRAG Sustainability Reporting Board (SRB), an approved version will be opened for public consultation.

For companies required to comply with the Corporate Sustainability Reporting Directive (CSRD), this guidance will offer practical advice on addressing challenges related to disclosing transition plans.

Financial Disclosure Frameworks

IIGCC publishes new guidance to help investors measure and reduce Scope 3 emissions

New guidance published by the Institutional Investors Group on Climate Change (IIGCC), aims to support financers in better measuring and reducing their Scope 3 emissions. The document outlines how financers should measure and how they can reduce Scope 3 emissions produced by the companies and projects they invest in.

IIGCC details the considerations and strategic approaches investors need to utilise to invest in line with the global net-zero transition. The report discusses the importance of investor climate strategies including material Scope 3 emission sources, avoiding loopholes that may exclude sources, and accurately estimating and considering the scale of systemic risks that will arise from failings to accelerate decarbonisation across the value chain.

The common challenges businesses face in measuring and disclosing their Scope 3 emissions, particularly highlighting the lack of supplier-specific data, which often requires businesses to use an assumption-based approach such as spend-based factors are also discussed in the report.

For investors facing challenges with measuring Scope 3 emissions, the IIGCC recommends material Scope 3 sources to be prioritised at the beginning of the decarbonisation process and investors should conduct a materiality assessment to identify the investments or funds that are most likely to have material Scope 3 emissions. Additionally, a sector-specific approach is advised as materiality typically varies by sector and scope 3 categories.

FCA SDR extends the deadline for compliance with the UK’s sustainable fund naming and marketing rules.

The Financial Conduct Authority (FCA) has extended the deadline for funds to comply with the UK’s sustainable fund naming and marketing rules.

Under the new rules, any fund that includes “impact” or “sustainable” in its name must adopt one of four approved labels by the 2nd December. However, the FCA recently announced that asset managers who submit an application by the start of October for funds requiring renaming will have their deadline extended to April next year.

This extension follows criticism from asset managers regarding the “frustrating” approval process, vague feedback, and overly prescriptive requirements. While the FCA does not directly approve the use of specific labels, it must be notified when an asset manager intends to use one. Additionally, the regulator must sign off on changes such as fund renaming, or prospectus updates made to meet the labelling criteria.

Although approval typically takes up to 30 days, many managers have faced multiple rounds of informal discussions, with some experiencing rejections or being asked to withdraw and resubmit applications, further delaying the process.

The FCA’s extension is designed to offer greater flexibility for both asset managers and the regulator, allowing more time to refine approaches to the Sustainable Disclosure Requirements (SDR) and streamline the approval process.

The deadline for the Financial Institutions Net Zero (FINZ) Standard public consultation and the feedback period for the Scope 3 Discussion Paper have been extended.

The Science Based Targets initiative (SBTi) is inviting experts from the finance sector, academia, and civil society worldwide to review and provide input on the Draft Financial Institutions Net-Zero (FINZ) Standard. To give stakeholders sufficient time to contribute, the deadline has been extended to the 30th September.

The consultation survey seeks feedback on the FINZ Standard – Consultation Draft v0.1, with a focus on:

- Clarity of the standard

- Specific approaches to:

- Demonstrating entity-level commitments and leadership

- Assessing exposure and portfolio emissions

- Setting portfolio climate alignment targets

- Developing targets for emissions-intensive sectors

- Reporting requirements

- The SBTi’s strategic direction for financial institutions

- Areas for improvement and additional support

Companies interested in participating are encouraged to complete the survey.

Climate Bonds Initiative (CBI) launches resilience and adaptation taxonomy

The Climate Bonds Initiative (CBI) has released a long-awaited update to its pioneering Climate Bonds taxonomy, originally introduced in 2012 as the first sustainable finance framework. The taxonomy was developed with Cadlas, a sustainable finance advisory, and a CBI-led advisory group.

The new adaptation and resilience taxonomy, developed in collaboration with the UN Office for Disaster Risk Reduction, focuses on actions to withstand climate hazards. It builds on a 2023 proposal and outlines four investment types: adapting measures, adapted activities, enabling measures, and enabling activities.

The CBI has identified 1,444 eligible investments across seven sectors: agri-food, natural systems, health, social systems, cities, infrastructure, and industry. Over 400 activities are automatically aligned, while others must meet thresholds to avoid maladaptation risks, such as unintended negative consequences.

Each investment must contribute to climate resilience and avoid harming climate mitigation efforts. The CBI will publish further guidance and case studies and convene technical working groups to refine criteria.

GFANZ to Release Guidance on Developing ‘Transition-Informed’ Indexes

GFANZ, the organisation overseeing the largest coalition of financial institutions committed to net-zero goals, will release voluntary guidance next month on creating “transition-informed” indexes.

Representing over 675 financial institutions, including the Net-Zero Asset Owner Alliance and the Paris Aligned Asset Owners, GFANZ’s guidance will cover the development of “transition-informed” indexes, addressing differences between equities and fixed income, as well as primary versus secondary market activities.

Index-based investment has been identified as a key focus for GFANZ in 2024, to support the development of next-generation net-zero indices and help investors align their index-based strategies with the net-zero transition.

Voluntary Disclosure Frameworks

CDP publishes guidance on the Corporate Sustainability Due Diligence Directive

CDP has published guidance on the Corporate Sustainability Due Diligence Directive (CSDDD), which discusses the importance of the Directive for addressing adverse human rights and environmental issues within a company’s operations, value chain and subsidiaries. CDP has stated its commitment to supporting and collaborating with stakeholders to help prepare organisations to comply with the CSDDD and achieve its objectives.

The document details the context and objectives of the CSDDD, whilst discussing its link with other important legislation such as the CSRD. Importantly, the document also identifies the crucial links between the CDP disclosure platform and the environmental obligations under CSDDD, highlighting how reporting to CDP can support and streamline the due diligence process under CSDDD.

For those companies that must comply with CSDDD, this guidance usefully informs the benefits companies receive by disclosing through CDP and how it can support companies’ due diligence journey.

MSCI Introduces Carbon Project Ratings

MSCI has unveiled a Carbon Project Ratings tool to support carbon credit buyers, investors and developers in assessing the quality and integrity of carbon projects.

This launch comes as the demand for carbon offset projects and credits is expected to rise in the coming years, driven by more companies setting net-zero targets and using offsets to complement their emission reduction strategies or to mitigate unavoidable emissions. Meanwhile, the Voluntary Carbon Market has faced challenges that have led to concerns over the credibility of carbon credits. Many buyers struggle to differentiate between high and low-quality projects due to inconsistent or insufficient data.

The new rating will assess over 4,000 carbon offset projects, based on various criteria such as the project’s impact on climate, environment, and society, and its legal and ethical risks such as financial crime, fraud and sanctions.

Projects will be assessed in two key areas: 1) emissions impact, and 2) implementation integrity. These will be rated on a 7-point scale from AAA to CCC, with AAA indicating a high likelihood of achieving 1 tonne of emissions reduction per credit, while also delivering positive social or environmental benefits and adhering to legal and ethical standards.

MSCI’s new carbon ratings reflect the growing trend toward more stringent and reliable carbon offsetting standards. Companies exploring carbon offsets should familiarise themselves with MSCI’s Carbon Project Ratings to ensure the carbon credits they purchase reduce 1 tonne of emissions per credit and provide genuine environmental and social benefits.

TISFD has officially launched

The Taskforce on Inequality and Social-related Financial Disclosures (TISFD) was officially launched this month. Its framework is designed to help companies more effectively disclose their impacts, dependencies, risks, and opportunities related to social issues and inequality. The goal is to enhance the quality of information regarding the effects of inequality and to enable market participants to better understand and manage social risks.

Companies seeking to improve their reporting, awareness, and understanding of social and inequality-related risks, opportunities, impacts, and dependencies are encouraged to familiarise themselves with the TISFD framework.

TISFD and EFRAG partner on social disclosures

EFRAG has collaborated with the newly launched TISFD to improve social-related financial disclosures. Both organisations aim to coordinate their efforts in developing global frameworks for reporting on inequality and social impacts. This includes participating in each other’s working groups, offering tools and guidance to support businesses in adopting the European Sustainability Reporting Standards and TISFD requirements, and promoting transparent, responsible business

IFRS Foundation Releases Guidance to Help Companies Voluntarily Adopt ISSB Sustainability Reporting Standards

The IFRS Foundation has published a new guide to assist companies in voluntarily adopting the International Sustainability Standards Board’s (ISSB) recently issued climate and sustainability disclosure standards, enabling them to better communicate their progress to investors.

The International Sustainability Standards Board was established by the IFRS Foundation in November 2021 to develop IFRS Sustainability Disclosure Standards, providing investors with insights into companies’ sustainability risks and opportunities. In June 2023, the IFRS released its first general sustainability (IFRS S1) and climate (IFRS S2) reporting standards.

Since the standards were introduced, numerous regulators worldwide have announced their intent to incorporate them. As of May 2024, the IFRS reported that over 20 jurisdictions, representing nearly 55% of global GDP, more than 40% of global market capitalisation, and more than half of global greenhouse gas emissions, have adopted or are moving to integrate the ISSB standards into their frameworks.

The IFRS Foundation’s new publication, “Voluntarily Applying ISSB Standards – A Guide for Preparers,” is intended to help companies, especially in regions without mandatory requirements, meet investor demand for sustainability reporting that aligns with the emerging global standards.

Assessing Transition Plans Collective (ATPC) has published new guidance for assessing net-zero transition plan credibility

The Assessing Transition Plans Collective (ATPC) has released updated guidance aimed at evaluating the credibility of net-zero transition plans.

The ATPC, comprising around 90 experts from over 40 organisations, is co-chaired by the World Benchmarking Alliance (WBA) and the Columbia Center on Sustainable Investment (CCSI).

This new guidance seeks to streamline and harmonise global assessment practices by focusing on the credibility, ambition, and achievability of transition plans, helping to reduce the confusion caused by the growing number of methods and tools used to assess these plans. It also underscores the importance of considering factors like nature, just transition, and local contexts when developing transition strategies.

According to the guidance, credible transition plans should align with:

- International decarbonisation targets;

- Local plans tailored to a company’s operational context;

- Realistic timelines, while incorporating principles of consistency, long-term value, ambition, and transparency.

This framework builds on the work of the UK Transition Plan Taskforce (TPT), which launched in April 2022 and published guidance in 2023. The TPT’s recommendations help businesses align with global standards and provide insights into creating and publishing future transition plans.

By harmonising guidance and clarifying assessment criteria, the ATPC aims to simplify the plan creation process, reduce confusion, and support businesses in crafting credible transition plans that accelerate the shift to a net-zero economy.

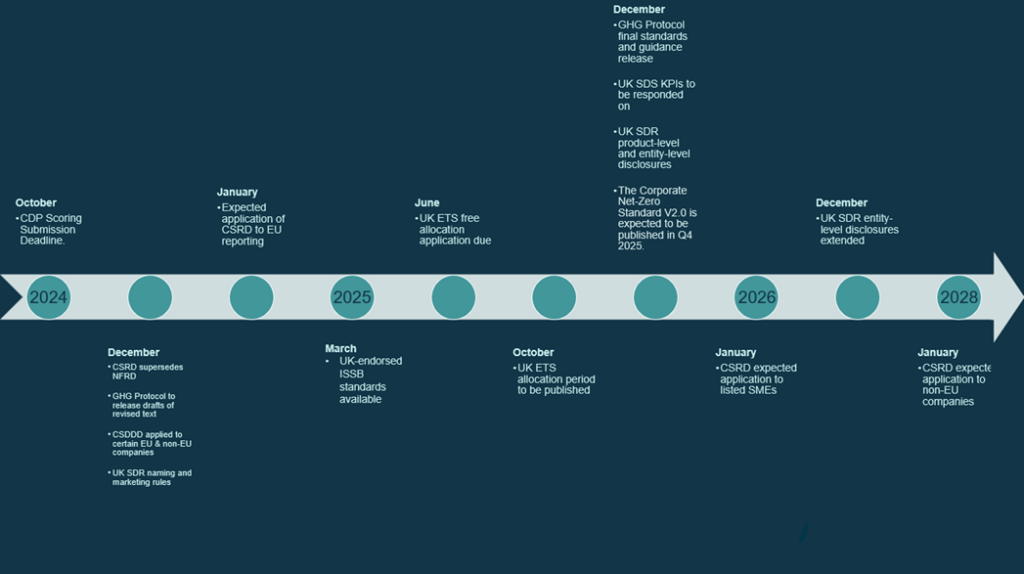

Horizon Scanning

| Date expected | Framework | Description |

|---|---|---|

| October 2024 | CDP | Scoring Submission Deadline |

| November 2024 | – | ESMA sustainability find-naming rules come into effect for new funds |

| December 2024 | UK SDR | Naming and marketing rules come into force, with accompanying disclosures, from 2 December |

| 2024 | CSRD | Due to supersede NFRD in 2024. Large companies already subject to NFRD must begin reporting on the fiscal year 2024. Drafting of sectoral-ESRS. |

| 2024 | CSDDD | Application of CSDDD to certain EU and non-EU companies expected to begin at some stage in 2024 |

| 2024 | GHG Protocol | Expected to release drafts of revised text |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| June 2025 | UK ETS | The window for operators of installations to apply for free allocation, or to be in the schemes for hospital or small emitters or for ultra-small emitters, in the 2026-2030 allocation period is 1 April – 30 June 2025. |

| October 2025 | UK ETS | Hospitals or small emitters and ultra-small emitters for the 2026-2030 allocation period must be published by 17 October 2025 |

| November 2025 | ISO | ISO is expected to launch its first International Standard on Net Zero at COP30. |

| December 2025 | UK SDR | Ongoing product-level and entity-level disclosures for firms with AUM>£50bn, from 2 December |

| December 2025 | SBTi | The Corporate Net-Zero Standard V2.0 is expected to be published in Q4 2025. |

| March 2025 | UK SDR | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SRS |

| April 2025 | UK SDR | Extended deadline for the UK’s sustainable fund naming and marketing rules. |

| April 2025 | EFRAG | EFRAG plans to release transition plan guidance. |

| May 2025 | ESMA | ESMA sustainability find-naming rules come into effect for existing funds. |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| 2025 | ESG Rating Providers | Planned UK regulation on ESG rating providers to come into effect. |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| February 2026 | UK ETS | Date before which the allocation table for the 2026-2030 allocation period must be published is 28 February 2026 |

| June 2026 | CSRD | Sector-specific standards to be published under the EU CSRD. |

| December 2026 | UK SDR | Entity-level disclosure rules extended to firms with AUM>£5bn, from 2 December |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

Funding

In its Autumn Statement 2022, the UK Government announced a new, long-term commitment to enhance energy efficiency, aiming to drive down costs for households, businesses, and the public sector with the end goal being a 15% reduction in the UK’s final energy consumption from buildings and industry by 2030 compared to 2021 levels.

This commitment took the form of new government funding worth £6 billion being made available from 2025 to 2028. These funds have recently been earmarked, in a government press statement on December 18, 2023, for various schemes aimed at delivering energy efficiency assistance to businesses and homes throughout the United Kingdom. Some of these schemes are new, while some are existing schemes that have been allocated more funding.

| Scheme | Allocation | Description | Years of funding in the next spending review period |

|---|---|---|---|

| Boiler Upgrade Scheme | £1.545bn | Replacing fossil fuel heating systems | 2025/2026 – 2027/2028 |

| Heat Pump Investment Accelerator | £15m | Bringing forward investment in the UK heat pump manufacturing supply chain | 2025/2026 |

| New £400m energy efficiency grant | £400m | For households in England to make changes such as bigger radiators or better insulation | 2025/2026 – 2027/2028 |

| New local authority retrofit scheme | £500m | Supporting low-income and cold homes with measures such as insulation | 2025/2026 – 2027/2028 |

| Social Housing Decarbonisation Fund | £1.253bn | Supporting social homes to be insulated or retrofitted | 2025/2026 – 2027/2028 |

| Green Heat Network Fund[1] | £485m | Helping homes and buildings access low carbon, affordable heating | 2025/2026 – 2027/2028 |

| Heat Network Efficiency Scheme[1] | £45m | Improving around 100 existing heat networks | 2025/2026 – 2027/2028 |

| Public Sector Decarbonisation Scheme | £1.17bn | Providing grants for public sector bodies to fund heat decarbonisation and energy efficiency measures | 2025/2026 – 2027/2028 |

| Industrial Energy Transformation Fund | £225m | Continuing to help businesses transition to a low-carbon future | 2025/2026 – 2027/2028 |

| Industrial Energy Efficiency and decarbonisation support | £410m | Further details to be announced in due course | 2025/2026 – 2027/2028 |

Sustainability Acronyms & Abbreviations

BVCM – Beyond Value Chain Mitigation

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESOS – Energy Savings Opportunity Scheme

ESRS – European Sustainability Reporting Standards

FCA – Financial Conduct Authority

FfB – Finance for Biodiversity

GHG Protocol – Greenhouse Gas Protocol

GFANZ – Glasgow Financial Alliance for Net Zero

GRI – Global Reporting Initiative

GSSB – Global Sustainability Standards Board

IIGCC – Institutional Investors Group on Climate Change

IETA – International Emissions Trading Association

ISSB – International Sustainability Standards Board

MESOS – Manage your Energy Savings Opportunity Scheme

NFRD – Non-Financial Reporting Directive

PAAO – Paris Aligned Asset Owners

SASB – Sustainability Accounting Standards Board

SBTi – Science-Based Targets Initiative

SDFR – Sustainable Finance Disclosure Regulation

TCFD – Taskforce for Climate Related Disclosure

TISFD – Taskforce on Inequality and Social-related Financial Disclosures

TPT – Transition Plan Taskforce

UK ETS – UK Emissions Trading Scheme

UK SDR – Sustainability Disclosure Requirements

UK SDS – Sustainability Disclosure Standards

US SEC – Securities and Exchange Commission

VCMI – Voluntary Carbon Markets Integrity Initiative