ESG Policies and Regulations Update October 2024

Keeping pace with net zero policies and regulation changes can pose a challenge. Our monthly updates are designed to provide you with the necessary support and guidance through the intricate landscape of ESG policies. We deliver the latest updates and significant developments concerning key sustainability frameworks, regulations, and standards from across the UK, EU, and US. We also delve into further detail on what you need to know.

In this month’s edition, we cover the UK government’s Autumn Budget and what this means for the UK’s Net Zero plans, as well as discuss Labour’s decision to extend the Climate Change Agreement scheme, which incentivises energy-intensive industries to progress in their decarbonisation efforts. We also examine the SBTi’s new fossil fuel rule for financial institutions with substantial investments in the sector and review IEMA’s newly published guidance designed to help SMEs align with the TNFD framework.

October update

| Framework | Update |

|---|---|

| UK Legislation | Labour’s Autumn Budget 2024: Net Zero summary. The UK government extends the Climate Change Agreement scheme to help decarbonise energy-intensive industries. |

| Financial Disclosure Frameworks | SBTi proposes a new fossil fuel rule for financial institutions. ESMA considering clarification to naming rules after green bond backlash. GFANZ releases guidance on developing ‘transition-informed’ Indexes. |

| US Legislation | California Governor Signs Climate Disclosure Bill into Law with 2026 Start Date. |

| Voluntary Disclosure Framework | CDP Submission Deadline Closed – 9th October 2024. TISFD plans to release a “beta version” of its disclosure framework in 2025. IEMA launches new guidance to help SMEs align with the TNFD framework. TNFD and GFANZ Launch Nature and Transition Plan Consultation Papers at COP 16. Science Based Targets Network (SBTN) announces the first 3 corporations to adopt science-based nature targets. |

Subscribe to newsletter

Receive our regulatory updates along with relevant news and insights in our monthly newsletters

Key Insights

UK Legislation

Labour’s Autumn Budget 2024: Net Zero summary

This week, the Labour government announced its autumn budget, detailing its plans to help ‘fix the foundations’ of the UK economy and drive towards long-term sustainable growth. This much anticipated budget proposed the allocation of funding needed to deliver on many of Labour’s pre-election promises to make Britain a clean energy superpower. It also builds on the momentum of earlier pledges to deliver net zero through targeted approaches to increase public and private investment in key sectors of the economy.

The government has already taken important steps to move the country towards low-carbon energy sources, with actions like reversing the de facto ban on onshore wind in England and the approval of four major solar projects. Labour’s key goals for boosting investment in financial services, renewable energy, and other Net Zero initiatives, as outlined in Make Britain a Clean Energy Superpower and Financing Growth, published in the spring, look to be addressed in their autumn budget. While the budget primarily focusses on the country’s financial deficit and cost of living there are certainly signs the point to progress on climate-related policy, though debate will persist in whether it is enough.

Driving investment into clean energy

The budget earmarked £125 million next year for Great British Energy, which aims to help unlock private investment into renewable energy projects. This marks the first instalment for the publicly owned company, which Labour have promised to provide with £8.3 billion over the next five years. This investment will give greater certainty to investors on the long-term viability of renewable energy in the UK and could help crowd-in up to £60 billion in private investment in the years to come.

The government also took a step towards greater energy security through its provision of £2.7 billion to advance Sizewell C’s (proposed new nuclear power station) development through 2025-26. The budget also promised support for the first round of electrolytic hydrogen production contracts, which if developed using green energy allows for carbon free energy storage that has applications for decarbonising transportation and heating – two major decarbonisation challenges in the UK. These budget commitments signal the direction of the new Government towards achieving their climate pledges. The increasing of the windfall tax, from 35-38%, provides another sign of the government’s stance on high-carbon energy sources, but can also be seen as opportunistic for helping to fill the budget deficit.

Finally, Labour has committed to securing the UK as a global leader in clean energy, while still driving economic growth and providing skilled jobs to the economy. The budget outlined its plans to respond to the recent Climate Change Committee Progress Report, which highlighted the opportunity for the country to benefit from the falling costs of low-carbon technologies and invest in renewable energy. The response will take the form of a detailed Clean Power 2030 Action Plan as well as a Carbon Budget Delivery Plan, which aims to capitalise on the UK’s strengths in the renewable energy industry and reduce its reliance on fossil fuels.

Further steps towards decarbonisation

The government also laid out their proposals to phase out combustion engines and move towards electric vehicles. These plans included expanding electric charge points, grants to help with the purchase of EV’s, and tax incentives for consumers. Expanding the grid, another barrier to decarbonisation in the UK, plans to be accelerated as part of the government’s plan. This is an essential step to integrating clean energy projects and ensuring that the UK reaches its renewable energy potential. The budget also detailed money to be allocated for the Warm Homes Plan which aims to increase household efficiency. Finally, the government touched upon plans for investing in climate mitigation and adaptation, with £5 billion pledged to support the transition to a more sustainable agricultural sector.

A strong start for Labour’s Net Zero Plans?

The autumn budget demonstrates a strong emphasis on renewable energy and transport decarbonisation, upholding many of the policies outlined by the Labour Party prior to the election. This budget demonstrates the government’s determination to deliver on its goals for net zero, which is a much-needed step in the right direction for the UK to establish its leadership potential in decarbonisation and to capitalise on the economic opportunities of clean energy and net zero technologies.

However, despite this promising start, questions remain around the government’s overarching strategy to reach net zero and uphold its international climate commitments. A comprehensive, economy-wide net zero approach is sorely needed, to provide companies and investors with a plan for the future and help perpetuate growth towards decarbonisation. It remains to be seen whether Labour will expand their policies to encompass a broader, more integrated approach, comparable to the EU’s Green Deal Industrial Plan and the USA’s Inflation Reduction Act, which will boost the economy and provide the stability and long-term vision the country needs.

Government extends the Climate Change Agreement scheme to help decarbonise energy-intensive industries

The UK Government has extended the Climate Change Agreement (CCA) scheme for an additional six years, offering £310 million in annual support to energy-intensive industries.

Launched in 2014, the CCA scheme provides tax breaks to businesses that improve energy efficiency and reduce their Scope 1 and Scope 2 emissions. Companies meeting energy-reduction targets receive discounts on the Climate Change Levy (CCL) on their energy bills.

Initially set to end in 2023, the scheme was extended to March 2025 and has now been further extended by the Department for Energy Security and Net Zero (DESNZ) until 2030. The first new target period will start on the 1st January 2026. The extension aims to give businesses long-term certainty for energy efficiency investments and will also open the scheme to new applicants, expanding its impact.

Financial Disclosure Frameworks

SBTi proposes a new fossil fuel rule for financial institutions

The SBTi is encouraging a wide range of financial institutions to adopt its new climate target-setting framework for the sector.

Recognising the importance of involving institutions with significant fossil fuel investments, SBTi aims to support these organisations in structuring their climate strategies to achieve real-world emissions reductions, rather than penalising them.

The second draft of the framework, open for consultation until mid-October, expands SBTi’s guidelines by enabling target-setting for insurance underwriting and capital market activities alongside long-term net-zero goals.

Under the proposed rules, financial institutions adopting SBTi-approved targets will need to stop financing new fossil fuel projects and align their existing fossil fuel investments with a 1.5ºC climate target. This includes phasing out coal projects by 2030 in OECD countries and by 2040 elsewhere.

The framework introduces dual-tiered expectations based on a financial institution’s level of influence over client emissions. For example, project financing is considered to have significant influence, while SME loans are seen as having limited influence.

Financial institutions would also need to comply with any relevant legal requirements that may conflict with the SBTi standards.

Feedback from this consultation is crucial, as it’s the first time the SBTi is setting limits on fossil fuel financing. All input will be summarised and published, with any revisions requiring approval from the SBTi’s technical council and executive board before the final standard is released.

ESMA considering clarification to naming rules after green bond backlash

ESMA has announced plans to clarify naming rules for ESG funds after concerns were raised about the potential effects on the green bond market.

Under the new rules, set to take effect later this year for new funds and next year for existing ones, funds with sustainability-related terms in their names must apply exclusion criteria aligned with the EU’s Paris-aligned Benchmark (PAB) regulation. Transition funds will follow the less strict Climate Transition Benchmark (CTB) criteria.

PAB rules focus on excluding companies involved in norms violations or coal, oil, and gas production. Green bond investors are worried about the exclusion of utility companies generating more than 50% of their revenue from electricity with a carbon intensity above 100g CO2 per kWh, which could impact many green bond issuers.

ESMA is consulting national regulators ahead of an October deadline to confirm their compliance plans and will publish a list of regulators’ intentions after the deadline passes.

GFANZ releases guidance on developing ‘transition-informed’ Indexes

GFANZ, the organisation leading the largest coalition of financial institutions committed to net-zero goals, has issued draft guidance on “transition-informed” indexes. This guidance addresses a key issue that most current indexes don’t directly support real-world decarbonisation, as they typically overlook companies’ climate strategies and often exclude high-emission industries or impose challenging year-over-year emissions cuts that are difficult for both companies and index managers to maintain.

The consultation proposes three new index categories:

- Transition-potential: includes companies that show a clear ability to align with net-zero targets within a set timeframe.

- Transition-engaged: includes companies that are in the process of aligning or already aligned with net-zero goals, or that provide climate solutions.

- Net-zero: comprises companies that are fully aligned with net-zero goals or actively provide climate solutions.

These indexes aim to capture companies at varying stages of alignment with net-zero goals or those contributing climate solutions. GFANZ views index-based investing as a priority for 2024, aiming to help investors align more effectively with the net-zero transition.

US Legislation

California Governor Signs Climate Disclosure Bill into Law with 2026 Start Date

California Governor Gavin Newsom has signed a new bill requiring large companies operating in the state to disclose their value chain emissions and report on climate-related financial risks. Despite earlier concerns about companies’ readiness to meet the deadline, the bill retains the originally proposed start date for reporting.

This law will apply to businesses operating in California and will effectively introduce climate reporting requirements for many companies across the U.S.

Voluntary Disclosure Frameworks

CDP Submission Deadline Closed – 9th October 2024

The deadline for submitting the 2024 CDP response has officially closed! Congratulations to everyone who completed this year’s submission! We know it’s no small feat, especially with the significant updates to the 2024 questionnaire, which now integrates Climate Change, Water, and Forest themes into one comprehensive questionnaire, alongside the introduction of new sections on plastics and biodiversity.

What’s next?

Although CDP 2025 may seem far off, CDP continues to elevate its disclosure standards each year to encourage greater accountability and transparency in environmental reporting. It’s never too early to assess your organisation’s performance, identify gaps in your CDP response, and start building streamlined processes and data collection methods to boost your sustainability efforts for the future.

Acclaro offers support throughout the entire CDP submission process and beyond. Get in touch to find out what we can do for your organisation.

TISFD plans to release a “beta version” of its disclosure framework in 2025

The TISFD has announced plans to develop a “beta version” of its disclosure framework by late 2025, with a full public release expected in late 2026. This framework will be accompanied by implementation guidance and best practice recommendations.

Designed to provide a standardised global framework, the TISFD’s disclosure system will guide businesses and financial institutions in reporting their social and inequality-related impacts, dependencies, risks, and opportunities. It will follow the same four-pillar structure seen in the TCFD and TNFD frameworks and align with the IFRS Sustainability Disclosure Standards.

The framework will address various dimensions of inequality, including horizontal inequalities (e.g., gender and race), vertical inequalities (e.g., income and life expectancy), and geographic-based disparities.

In addition, it will support a double materiality approach focusing on both financial materiality (focused on information important to investors and lenders) and impact materiality (focused on information relevant to stakeholders assessing social impacts).

The TISFD also plans to collaborate with standard-setters in different regions to explore how its framework can support and enhance current and future regulations and reporting standards.

IEMA launches new guidance to help SMEs align with the TNFD framework

The TNFD recommendations, launched last year, aim to help the private sector address ecological impacts by encouraging businesses to report on their environmental footprint and integrate nature-related factors into their strategies using science-based targets.

IEMA’s new guide, Business Actions on TNFD: A Primer on Roles and Reporting, explains how environmental and sustainability professionals can use the TNFD framework. It answers common questions and helps businesses manage nature-related risks effectively.

Tom Mason, associate director at Nature Positive, highlighted that SMEs stand to benefit from aligning with TNFD as they can more easily adapt to emerging regulatory and environmental challenges due to their closer relationships with suppliers.

The guide also links TNFD guidelines with IEMA membership levels, clarifying how different professionals can engage with the framework. TNFD disclosures are not yet mandatory in any market.

TNFD and GFANZ Launch Nature and Transition Plan Consultation Papers at COP 16

TNFD

At COP 16, the Taskforce on Nature-related Financial Disclosures (TNFD) unveiled its draft guidance on nature transition planning. This guidance is intended to help corporations and financial institutions design and transparently disclose a transition plan that aligns with TNFD’s recommended disclosures.

TNFD’s draft defines “a nature transition plan as an aspect of an organisation’s overall business strategy that lays out the organisation’s goals, targets, actions, accountability mechanisms and intended resources to respond and contribute to the transition implied by the Global Biodiversity Framework where biodiversity loss is halted and reversed by 2030 to put nature on a path to recovery by 2050”.

The TNFD draft builds on existing practices for climate transition planning, drawing from the Glasgow Financial Alliance for Net Zero (GFANZ) and the Transition Plan Taskforce (TPT) recommendations on climate-related disclosures. Stakeholders are invited to provide feedback until the 1st February 2025, with the final guidance expected to be published in 2025.

GFANZ

In a separate announcement, GFANZ released a consultation paper focused on integrating nature considerations into net-zero transition planning. This guidance supplements GFANZ’s Net-Zero Transition Plan Framework (NZTPF), expanding the framework to support financial institutions in accounting for nature in their transition strategies.

The paper highlights two primary “climate-related levers”:

- Natural Climate Mitigation: Place-based activities like ecosystem protection, conservation, restoration, and improved land management that aim to reduce GHG emissions or enhance carbon storage.

- Natural Climate Enablers: Non-place-based activities that indirectly impact ecosystem management, including producing inputs for natural climate mitigation and creating low-carbon alternatives that support emissions reduction and boost natural GHG sinks.

GFANZ recommends evaluating new and existing products and services for their potential to support these nature-focused strategies, especially through important aspects of product design. Stakeholders are encouraged to submit feedback by the 17th January 2025, with the final paper set for release in Q1 2025.

Science Based Targets Network (SBTN) announces the first 3 corporations to adopt science-based nature targets.

Three companies have publicly adopted validated science-based targets for the first time, following their participation in the Science Based Targets Network’s (SBTN) year-long corporate pilot program. Kering, a global luxury group, adopted science-based targets for both freshwater and land, whilst GSK, a global biopharma company, and Holicom, a building materials company, have adopted science-based targets for freshwater.

The SBTN state setting validated science-based targets for nature is a crucial step for companies to achieve the Global Biodiversity Framework and reverse and halt nature loss by 2030. The science-based targets for nature will inform companies if they are implementing enough of the right actions, in the correct places and at the right time to address the drivers and pressures causing nature loss.

The other companies participating in the pilot program have until the 10th January to publicly adopt science-based targets for nature. In early 2025, the SBTN will also publish a corporate tracker to provide transparency on the targets set.

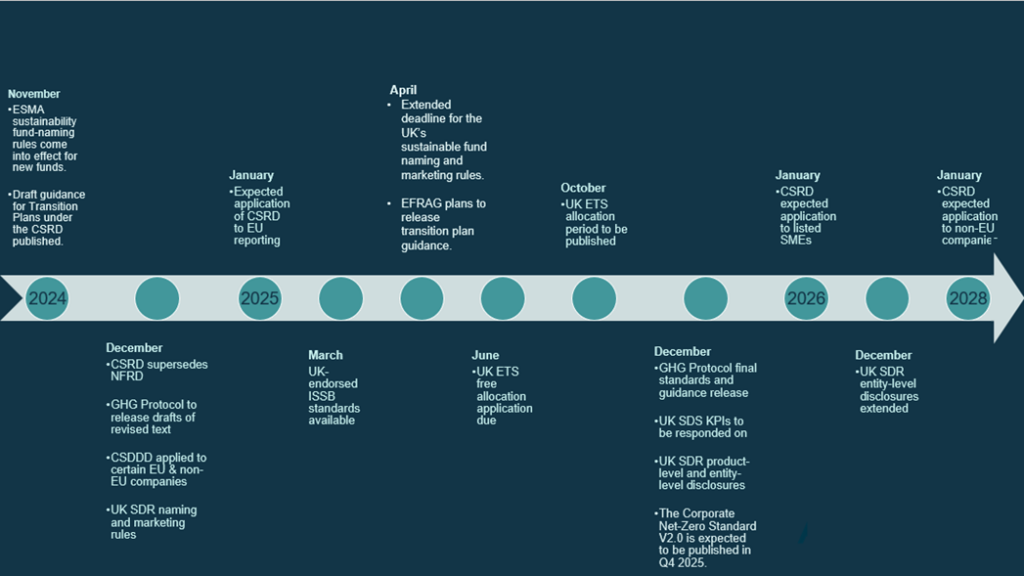

Horizon Scanning

| Date expected | Framework | Description |

| November 2024 | ESMA sustainability fund-naming rules come into effect for new funds. | |

| November 2024 | CSRD | Draft guidance for Transition Plans under the CSRD published. |

| December 2024 | UK SDR | Naming and marketing rules come into force, with accompanying disclosures, from 2 December |

| 2024 | CSRD | Anticipated adoption of the second draft of ESRS |

| 2024 | CSRD | Due to supersede NFRD in 2024. Large companies already subject to NFRD must begin reporting on the fiscal year 2024. Drafting of sectoral-ESRS. |

| 2024 | CSDDD | Application of CSDDD to certain EU and non-EU companies expected to begin at some stage in 2024 |

| 2024 | GHG Protocol | Expected to release drafts of revised text |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| January 2025 | GFANZ | GFANZ plans to publish guidance on integrating nature considerations to support net-zero transition planning. |

| January 2025 | SBTN | SBTN publish corporate tracker on nature targets set. |

| June 2025 | UK ETS | The window for operators of installations to apply for free allocation, or to be in the schemes for hospital or small emitters or for ultra-small emitters, in the 2026-2030 allocation period is 1 April – 30 June 2025. |

| October 2025 | UK ETS | Hospitals or small emitters and ultra-small emitters for the 2026-2030 allocation period must be published by 17 October 2025 |

| November 2025 | ISO | ISO is expected to launch its first International Standard on Net Zero at COP30. |

| December 2025 | UK SDR | Ongoing product-level and entity-level disclosures for firms with AUM>£50bn, from 2 December |

| December 2025 | SBTi | The Corporate Net-Zero Standard V2.0 is expected to be published in Q4 2025. |

| March 2025 | UK SDR | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SRS |

| April 2025 | UK SDR | Extended deadline for the UK’s sustainable fund naming and marketing rules. |

| April 2025 | EFRAG | EFRAG plans to release transition plan guidance. |

| May 2025 | ESMA | ESMA sustainability find-naming rules come into effect for existing funds. |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| 2025 | ESG Rating Providers | Planned UK regulation on ESG rating providers to come into effect. |

| 2025 | TNFD | TNFD publishes its nature transition plan. |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| February 2026 | UK ETS | Date before which the allocation table for the 2026-2030 allocation period must be published is 28 February 2026 |

| June 2026 | CSRD | Sector-specific standards to be published under the EU CSRD. |

| Late 2026 | TISFD | TISFD disclosure framework released. |

| December 2026 | UK SDR | Entity-level disclosure rules extended to firms with AUM>£5bn, from 2 December |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

Funding

In its Autumn Statement 2022, the UK Government announced a new, long-term commitment to enhance energy efficiency, aiming to drive down costs for households, businesses, and the public sector with the end goal being a 15% reduction in the UK’s final energy consumption from buildings and industry by 2030 compared to 2021 levels.

This commitment took the form of new government funding worth £6 billion being made available from 2025 to 2028. These funds have recently been earmarked, in a government press statement on December 18, 2023, for various schemes aimed at delivering energy efficiency assistance to businesses and homes throughout the United Kingdom. Some of these schemes are new, while some are existing schemes that have been allocated more funding.

| Scheme | Allocation | Description | Years of funding in the next spending review period |

|---|---|---|---|

| Boiler Upgrade Scheme | £1.545bn | Replacing fossil fuel heating systems | 2025/2026 – 2027/2028 |

| Heat Pump Investment Accelerator | £15m | Bringing forward investment in the UK heat pump manufacturing supply chain | 2025/2026 |

| New £400m energy efficiency grant | £400m | For households in England to make changes such as bigger radiators or better insulation | 2025/2026 – 2027/2028 |

| New local authority retrofit scheme | £500m | Supporting low-income and cold homes with measures such as insulation | 2025/2026 – 2027/2028 |

| Social Housing Decarbonisation Fund | £1.253bn | Supporting social homes to be insulated or retrofitted | 2025/2026 – 2027/2028 |

| Green Heat Network Fund[1] | £485m | Helping homes and buildings access low carbon, affordable heating | 2025/2026 – 2027/2028 |

| Heat Network Efficiency Scheme[1] | £45m | Improving around 100 existing heat networks | 2025/2026 – 2027/2028 |

| Public Sector Decarbonisation Scheme | £1.17bn | Providing grants for public sector bodies to fund heat decarbonisation and energy efficiency measures | 2025/2026 – 2027/2028 |

| Industrial Energy Transformation Fund | £225m | Continuing to help businesses transition to a low-carbon future | 2025/2026 – 2027/2028 |

| Industrial Energy Efficiency and decarbonisation support | £410m | Further details to be announced in due course | 2025/2026 – 2027/2028 |

Sustainability Acronyms & Abbreviations

BVCM – Beyond Value Chain Mitigation

CBI – Climate Bonds Initiative

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESOS – Energy Savings Opportunity Scheme

ESRS – European Sustainability Reporting Standards

FCA – Financial Conduct Authority

FfB – Finance for Biodiversity

FINZ – Financial Institutions Net Zero

GHG Protocol – Greenhouse Gas Protocol

GFANZ – Glasgow Financial Alliance for Net Zero

GRI – Global Reporting Initiative

GSSB – Global Sustainability Standards Board

IIGCC – Institutional Investors Group on Climate Change

IETA – International Emissions Trading Association

ISSB – International Sustainability Standards Board

MESOS – Manage your Energy Savings Opportunity Scheme

NFRD – Non-Financial Reporting Directive

PAAO – Paris Aligned Asset Owners

SASB – Sustainability Accounting Standards Board

SBTi – Science-Based Targets Initiative

SBTN – Science-Based Targets Network

SDFR – Sustainable Finance Disclosure Regulation

TCFD – Taskforce for Climate Related Disclosure

TISFD – Taskforce on Inequality and Social-related Financial Disclosures

TNFD – Taskforce on Nature-related Financial Disclosures

TPT – Transition Plan Taskforce

UK ETS – UK Emissions Trading Scheme

UK SDR – Sustainability Disclosure Requirements

UK SDS – Sustainability Disclosure Standards

US SEC – Securities and Exchange Commission

VCMI – Voluntary Carbon Markets Integrity Initiative