ESG Policies and Regulations Update November 2024

Keeping pace with net zero policies and regulation changes can pose a challenge. Our monthly updates are designed to provide you with the necessary support and guidance through the intricate landscape of ESG policies. We deliver the latest updates and significant developments concerning key sustainability frameworks, regulations, and standards from across the UK, EU, and US. We also delve into further detail on what you need to know.

In this month’s edition, we explore the FCA’s new ‘Good Practice’ Guidance for SDR label applicants, as well as EFRAG’s draft Transition Plan Guidance ahead of its final publication in April 2025. We also cover the Transition Plan Taskforce’s transfer of responsibilities to the IFRS Foundation and CDP’s new interoperability agreements with EFRAG and GRI.

November update

| Framework | Update |

|---|---|

| UK Legislation | Key Sustainability Takeaways from Rachel Reeves’ Mansion House Speech. FCA Issues ‘Good Practice’ Guidance for SDR Label Applicants. |

| Financial Disclosure Frameworks | EFRAG Releases Draft Transition Plan Guidance. |

| Voluntary Disclosure Framework | Transition Plan Taskforce (TPT) Transfers Responsibilities to IFRS Foundation. ISO 14068: The New Standard for Carbon Neutrality. CDP and EFRAG Announce Interoperability Agreement. CDP and GRI Forge New Cooperation Agreement. IAASB Publishes New International Sustainability Assurance Standard. REDD+ Gains Approval for Updated Carbon Credit Methodologies. UK Government Unveils 6 Key Principles for Corporate Use of Carbon Credits. ISO launches Principles for ESG Performance and Reporting. IFRS Foundation Releases Guide to Help Companies Identify and Report Sustainability Risks and Opportunities. |

Subscribe to newsletter

Receive our regulatory updates along with relevant news and insights in our monthly newsletters

Key Insights

UK Legislation

Key Sustainability Takeaways from Rachel Reeves’ Mansion House Speech

On November 14, 2024, Rachel Reeves, the newly appointed Chancellor of the Exchequer, delivered her inaugural Mansion House speech. She used the occasion to unveil reforms aimed at boosting growth and competitiveness within the financial services sector. A major theme of her address was sustainable finance, with a focus on restoring the UK’s position as a global leader in this area. The government’s plans include:

- UK Sustainability Reporting Standards: Launching a consultation on requiring the largest companies to report in line with the UK-endorsed International Sustainability Standards Board (ISSB) standards, subject to final ministerial approval.

- Transition Plans: Consulting in early 2025 to advance the manifesto pledge on transition plans, reinforcing the UK’s ambition to become a global hub for transition finance and ensure the UK’s regulatory framework supports growth, remains internationally competitive, and sustains its global financial leadership.

- UK Green Taxonomy: Gathering feedback on the value case for introducing a UK Green Taxonomy as part of a broader sustainable finance framework. The consultation, open until 11:59 PM on 6th February 2024, aims to develop a pragmatic and holistic approach to sustainable finance.

FCA Issues ‘Good Practice’ Guidance for SDR Label Applicants

The FCA has published a new document offering examples of pre-contractual disclosures for firms applying for fund labels under the Sustainable Disclosure Requirements (SDR) regime. This guidance aims to assist applicants in preparing their documentation effectively.

The release responds to criticism about the time-consuming and complex application process for SDR fund labels, particularly challenges in crafting appropriate disclosures.

The guidance outlines examples of good practices for the ‘Sustainability Improvers’ and ‘Sustainability Focus’ labels. These examples cover key areas such as fund objectives, their connection to outcomes, investment criteria, and monitoring policies. Based on the FCA’s experience with applications so far, these examples are illustrative rather than exhaustive.

The FCA also highlights poor disclosure practices that fail to meet SDR requirements, including:

- Asset selection processes that lack a clear link to the product’s sustainability objective.

- Inadequate explanation or evidence for scoring thresholds used to define sustainability.

- Failure to disclose manager overrides in asset selection where applicable.

This guidance addresses a pressing need for clarity, providing firms with valuable insights to streamline their application process.

Financial Reporting Frameworks

EFRAG Releases Draft Transition Plan Guidance

EFRAG has unveiled its first public draft of transition plan implementation guidance to assist companies in reporting under the EU’s corporate sustainability reporting standards. Developed in collaboration with the Sustainability Reporting Technical Expert Group (TEG), the guidance focuses on structuring climate change mitigation transition plans in alignment with the European Sustainability Reporting Standards (ESRS). Key areas include target compatibility, decarbonisation strategies, investment and funding, and supporting disclosures.

The draft outlines how the guidance aligns with broader EU frameworks, referencing regulations such as the EU Taxonomy and the Corporate Sustainability Due Diligence Directive (CSDDD). It also acknowledges additional resources, including those from GFANZ and the Transition Plan Taskforce (TPT), that companies may consider when preparing ESRS transition plan disclosures.

EFRAG plans to launch a consultation period for the guidance in January 2024, with the final version expected by April 2025.

These indexes aim to capture companies at varying stages of alignment with net-zero goals or those contributing climate solutions. GFANZ views index-based investing as a priority for 2024, aiming to help investors align more effectively with the net-zero transition.

Voluntary Disclosure Frameworks

Transition Plan Taskforce (TPT) Transfers Responsibilities to IFRS Foundation

The Transition Plan Taskforce (TPT) has officially concluded its work, transferring its responsibilities to the International Financial Reporting Standards (IFRS) Foundation to promote the adoption of ambitious and transparent climate transition plans.

Over the past two and a half years, the TPT has played a pivotal role in establishing a gold standard for private sector transition plans. It has become a key figure in the climate transition landscape, collaborating with over 500 financial institutions, corporations, policymakers, regulators, and civil society organisations in the UK and globally. Its work includes publishing extensive guidance, including sector-specific tools, to help businesses secure financing for achieving net zero emissions.

To mark its closure, the TPT published its final report, “Progress Achieved and the Path Ahead: The Final Report of the Transition Plan Taskforce.” The report highlights critical opportunities and challenges for global transition plan adoption, such as enhancing market capabilities, sharing best practices, developing decision-making tools, and fostering international consistency in transition planning standards.

The TPT’s technical work culminated in June 2024 with endorsement from the IFRS Foundation, which now has taken responsibility for its disclosure-related materials. This handover ensures that the TPT’s high standards and best practices will continue to shape global climate disclosure frameworks.

ISO 14068: The New Standard for Carbon Neutrality

ISO 14068 provides a clear framework for organisations, products, and events to achieve carbon neutrality, aligning with the broader net zero goal. As part of the ISO 14060 family, it focuses on GHG emissions reduction and removal, addressing the lack of a unified standard for managing and demonstrating carbon neutrality.

Previously, carbon neutrality claims relied on carbon footprint quantifications, following standards like ISO 14064 (organisations) and ISO 14067 (products). However, the lack of international consensus on how to move beyond quantification, to managing, achieving and demonstrating carbon neutrality resulted in inconsistent approaches with varying credibility. ISO 14068 sets a global benchmark, ensuring claims meet rigorous standards and reducing the risk of greenwashing.

Key Steps for ISO 14068 Compliance:

- Assess your GHG baseline.

- Prioritise emissions reductions and removals.

- Create and implement a carbon neutrality management plan.

- Offset residual emissions.

- Independently verify claims.

Increased regulatory scrutiny makes adherence to ISO 14068 essential for credible, transparent carbon neutrality. For more information, visit the ISO 14068 webpage here.

CDP and EFRAG Announce Interoperability Agreement

CDP and EFRAG have confirmed a collaboration to enhance interoperability between CDP’s framework and the European Sustainability Reporting Standards (ESRS). A detailed mapping of their alignment is set to be published early next year.

The initial focus will be on aligning CDP’s questionnaire with the ESRS climate standard (ESRS E1). In 2025, the partnership will explore further integration by identifying ESRS data points that could inform the development of future CDP questionnaires.

The agreement aims to streamline reporting requirements, reducing the burden on companies preparing to comply with the EU’s corporate sustainability reporting regulations.

CDP and GRI Forge New Cooperation Agreement

The Global Reporting Initiative (GRI) and CDP have announced a new partnership to enhance collaboration and align their reporting standards and platforms. This initiative aims to simplify sustainability reporting for companies and improve access to corporate environmental impact data.

GRI’s Sustainability Reporting Standards are widely used globally, offering consistent frameworks for companies across industries to communicate sustainability performance to diverse stakeholders, including investors. Meanwhile, CDP operates a global environmental disclosure system, enabling stakeholders to assess organisations’ performance on key issues such as climate change, deforestation, water security, and plastic-related impacts.

Under the agreement, GRI and CDP will work together to streamline disclosures, allowing companies to report GRI-aligned data through the CDP questionnaire. The partnership will include a joint mapping exercise to align the CDP questionnaire with GRI’s forthcoming standards on climate, energy, biodiversity, and water. This collaboration seeks to build capacity and reduce reporting burdens for businesses worldwide.

IAASB Publishes New International Sustainability Assurance Standard

The International Auditing and Assurance Standards Board (IAASB) has released the final version of its International Standard on Sustainability Assurance 5000 (ISSA 5000), setting a global benchmark for practitioners conducting sustainability assurance engagements.

The release comes as sustainability and climate-related reporting become increasingly prevalent, driven by regulatory requirements such as the EU’s Corporate Sustainability Reporting Directive (CSRD) and the IFRS standards issued by the International Sustainability Standards Board (ISSB).

ISSA 5000 supports both limited and reasonable assurance engagements and accommodates traditional materiality and double materiality approaches (used in regulations such as the CSRD).

The European Commission has tasked the Committee of European Auditing Oversight Bodies (CEAOB) with advising on incorporating ISSA 5000 into CSRD-related assurance requirements.

REDD+ Gains Approval for Updated Carbon Credit Methodologies

The ICVCM has approved three revamped REDD+ methodologies for issuing carbon credits, addressing concerns over loopholes in earlier versions. REDD+ credits enable organisations to offset one tonne of CO2e emissions by funding projects that prevent deforestation and forest degradation in biodiversity-rich areas of low- and middle-income countries.

Criticism of older REDD+ credits last year led to accusations of greenwashing, eroding trust among buyers. The newly approved methodologies, deemed more robust by the ICVCM, are:

- ART-TREES v2.0 (TREES Crediting Level)

- VCS VM0048 (Reducing Emissions from Deforestation and Forest Degradation v1.0)

- VCS JNR Framework v4.1 (Jurisdictional and Nested REDD+)

While no credits have been issued yet, over 323 million credits are awaiting verification under these methodologies. Jurisdictional approaches, such as ART-TREES and VCS-JNR, operate at national or state levels and are expected to integrate with national forestry policies and climate plans under the Paris Agreement.

The project-based VM0048 includes key improvements, such as stricter baseline settings using regional deforestation data instead of developer-defined metrics. This change aims to enhance the credibility of REDD+ credits and restore market confidence.

UK Government Unveils 6 Key Principles for Corporate Use of Carbon Credits

The UK Government has outlined six key principles to guide corporations in using carbon and nature credits as part of their efforts to achieve net zero. These voluntary principles, which will undergo consultation in 2025, aim to help businesses invest in high-integrity carbon credits.

Aligned with the UK’s goal to reduce emissions by 81% by 2035 compared to 1990 levels, these principles are designed to maximise financing for climate action while supporting nature restoration, in line with the Climate Change Committee’s recommendations.

The six principles are:

- Ensure credits demonstrate additionality.

- Use high-integrity credits.

- Disclose credit usage in reports.

- Integrate credits into long-term strategies.

- Make accurate claims.

- Collaborate to expand the market.

These principles provide actionable steps for businesses to build confidence in their carbon credit investments and address concerns about greenwashing.

ISO Launches ESG Performance and Reporting Principles

The International Organisation for Standardisation (ISO) has introduced the ISO ESG Implementation Principles to help companies improve ESG integration, performance, measurement, and reporting.

With increasing ESG regulations and scrutiny, including the EU’s CSRD and the UK’s Modern Slavery Act, ISO’s new guidance aims to address inconsistencies in sustainability reporting across sectors and jurisdictions. The principles, applicable to businesses of all sizes and various stakeholders, are designed to enhance ESG performance management, ensure consistency and reliability in reporting, and align with existing standards for clearer communication of sustainability efforts.

Developed with input from over 1,900 global experts and national standards bodies, the principles are available on ISO’s website.

IFRS Foundation Releases Guide to Help Companies Identify and Report Sustainability Risks and Opportunities

The IFRS Foundation has published a new guide to assist companies in identifying and disclosing material sustainability-related risks and opportunities that may affect their short- and long-term cash flows, access to finance, or cost of capital. The guide is designed to help companies assess materiality in the context of growing demand from investors and capital markets for this type of information.

A key focus of the guide is to help companies understand the concept of sustainability-related risks and opportunities under IFRS S1, particularly how they stem from a company’s dependencies and impacts. It also highlights how companies can leverage existing processes for making materiality judgments when preparing financial statements, especially under IFRS Accounting Standards.

Additionally, the guide outlines ways to connect sustainability-related financial disclosures with financial statements, and provides guidance for companies applying the ISSB Standards alongside the European Sustainability Reporting Standards (ESRS) or Global Reporting Initiative (GRI) Standards.

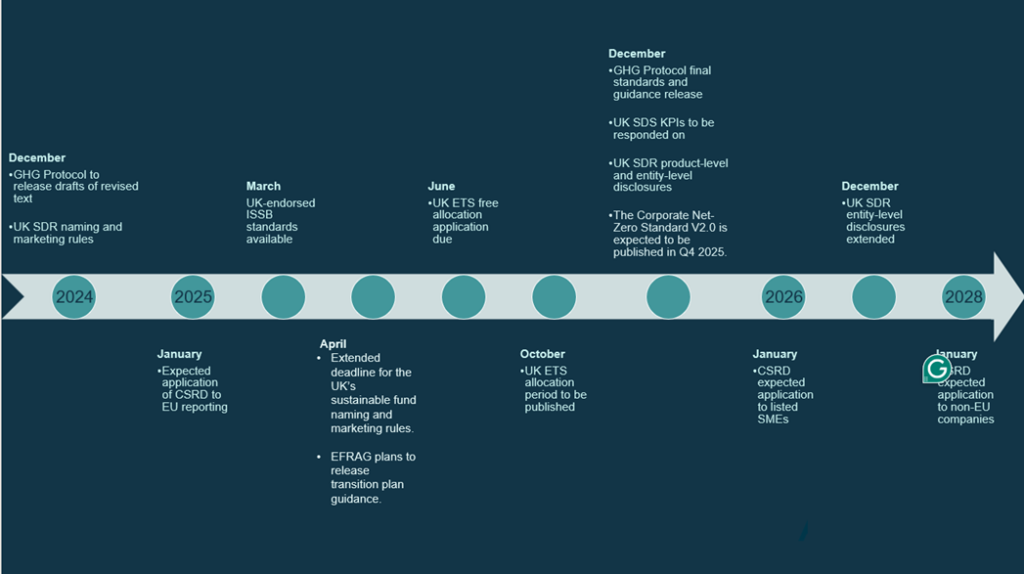

Horizon Scanning

| Date expected | Framework | Description |

| December 2024 | UK SDR | Naming and marketing rules come into force, with accompanying disclosures, from 2 December |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| January 2025 | GFANZ | GFANZ plans to publish guidance on integrating nature considerations to support net-zero transition planning. |

| January 2025 | SBTN | SBTN publish corporate tracker on nature targets set. |

| Early 2025 | CDP and EFRAG Mapping Document published. | |

| April | EFRAG | Transition Plan Guidance published. |

| June 2025 | UK ETS | The window for operators of installations to apply for free allocation, or to be in the schemes for hospital or small emitters or for ultra-small emitters, in the 2026-2030 allocation period is 1 April – 30 June 2025. |

| October 2025 | UK ETS | Hospitals or small emitters and ultra-small emitters for the 2026-2030 allocation period must be published by 17 October 2025 |

| November 2025 | ISO | ISO is expected to launch its first International Standard on Net Zero at COP30. |

| December 2025 | UK SDR | Ongoing product-level and entity-level disclosures for firms with AUM>£50bn, from 2 December |

| December 2025 | SBTi | The Corporate Net-Zero Standard V2.0 is expected to be published in Q4 2025. |

| March 2025 | UK SDR | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SRS |

| April 2025 | UK SDR | Extended deadline for the UK’s sustainable fund naming and marketing rules. |

| April 2025 | EFRAG | EFRAG plans to release transition plan guidance. |

| May 2025 | ESMA | ESMA sustainability find-naming rules come into effect for existing funds. |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| 2025 | ESG Rating Providers | Planned UK regulation on ESG rating providers to come into effect. |

| 2025 | TNFD | TNFD publishes its nature transition plan. |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| February 2026 | UK ETS | Date before which the allocation table for the 2026-2030 allocation period must be published is 28 February 2026 |

| June 2026 | CSRD | Sector-specific standards to be published under the EU CSRD. |

| Late 2026 | TISFD | TISFD disclosure framework released. |

| December 2026 | UK SDR | Entity-level disclosure rules extended to firms with AUM>£5bn, from 2 December |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

Funding

In its Autumn Statement 2022, the UK Government announced a new, long-term commitment to enhance energy efficiency, aiming to drive down costs for households, businesses, and the public sector with the end goal being a 15% reduction in the UK’s final energy consumption from buildings and industry by 2030 compared to 2021 levels.

This commitment took the form of new government funding worth £6 billion being made available from 2025 to 2028. These funds have recently been earmarked, in a government press statement on December 18, 2023, for various schemes aimed at delivering energy efficiency assistance to businesses and homes throughout the United Kingdom. Some of these schemes are new, while some are existing schemes that have been allocated more funding.

| Scheme | Allocation | Description | Years of funding in the next spending review period |

|---|---|---|---|

| Boiler Upgrade Scheme | £1.545bn | Replacing fossil fuel heating systems | 2025/2026 – 2027/2028 |

| Heat Pump Investment Accelerator | £15m | Bringing forward investment in the UK heat pump manufacturing supply chain | 2025/2026 |

| New £400m energy efficiency grant | £400m | For households in England to make changes such as bigger radiators or better insulation | 2025/2026 – 2027/2028 |

| New local authority retrofit scheme | £500m | Supporting low-income and cold homes with measures such as insulation | 2025/2026 – 2027/2028 |

| Social Housing Decarbonisation Fund | £1.253bn | Supporting social homes to be insulated or retrofitted | 2025/2026 – 2027/2028 |

| Green Heat Network Fund[1] | £485m | Helping homes and buildings access low carbon, affordable heating | 2025/2026 – 2027/2028 |

| Heat Network Efficiency Scheme[1] | £45m | Improving around 100 existing heat networks | 2025/2026 – 2027/2028 |

| Public Sector Decarbonisation Scheme | £1.17bn | Providing grants for public sector bodies to fund heat decarbonisation and energy efficiency measures | 2025/2026 – 2027/2028 |

| Industrial Energy Transformation Fund | £225m | Continuing to help businesses transition to a low-carbon future | 2025/2026 – 2027/2028 |

| Industrial Energy Efficiency and decarbonisation support | £410m | Further details to be announced in due course | 2025/2026 – 2027/2028 |

Sustainability Acronyms & Abbreviations

BVCM – Beyond Value Chain Mitigation

CBI – Climate Bonds Initiative

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESOS – Energy Savings Opportunity Scheme

ESRS – European Sustainability Reporting Standards

FCA – Financial Conduct Authority

FfB – Finance for Biodiversity

FINZ – Financial Institutions Net Zero

GHG Protocol – Greenhouse Gas Protocol

GFANZ – Glasgow Financial Alliance for Net Zero

GRI – Global Reporting Initiative

GSSB – Global Sustainability Standards Board

IIGCC – Institutional Investors Group on Climate Change

IETA – International Emissions Trading Association

ISSB – International Sustainability Standards Board

MESOS – Manage your Energy Savings Opportunity Scheme

NFRD – Non-Financial Reporting Directive

PAAO – Paris Aligned Asset Owners

SASB – Sustainability Accounting Standards Board

SBTi – Science-Based Targets Initiative

SBTN – Science-Based Targets Network

SDFR – Sustainable Finance Disclosure Regulation

TCFD – Taskforce for Climate Related Disclosure

TISFD – Taskforce on Inequality and Social-related Financial Disclosures

TNFD – Taskforce on Nature-related Financial Disclosures

TPT – Transition Plan Taskforce

UK ETS – UK Emissions Trading Scheme

UK SDR – Sustainability Disclosure Requirements

UK SDS – Sustainability Disclosure Standards

US SEC – Securities and Exchange Commission

VCMI – Voluntary Carbon Markets Integrity Initiative