ESG Policies and Regulations Update May 2024

Keeping pace with net zero policies and regulation changes can pose a challenge. Our monthly updates are designed to provide you with the necessary support and guidance through the intricate landscape of ESG policies. We deliver the latest updates and significant developments concerning key sustainability frameworks, regulations, and standards from across the UK, EU, and US, and delve into further detail on what you need to know.

In this month’s edition, we explore the UK Government’s 2024 Implementation Update for the Sustainability Disclosure Requirements (SDR), the publication of interoperability guidance by the International Financial Reporting Standards Foundation and European Financial Reporting Advisory Group to help companies effectively apply both ISSB and ESRS standards and the EU’s recent approval of the Corporate Sustainability Due Diligence Directive.

May update

| Framework | Update |

|---|---|

| UK Legislation | The UK Government releases the 2024 Implementation Update for the Sustainability Disclosure Requirements (SDR). The UK’s Financial Conduct Authority’s (FCA) anti-greenwashing rule applicable to all FCA-authorised firms became effective on 31st May. |

| EU Legislation | The European Securities and Market Authority issues final guidelines for ESG and Sustainability-Related Fund Names. The EU has published a summary report following a consultation on the implementation of the Sustainable Finance Disclosure Regulation. The EU officially approves the Corporate Sustainability Due Diligence (CSDDD). CSRD’s publication of its sustainability reporting standards has been delayed. |

| International Reporting Standards | International Financial Reporting Standards (IFRS) Foundation and European Financial Reporting Advisory Group (EFRAG) publish interoperability guidance to demonstrate the alignment between ISSB and ESRS for climate disclosures. GRI and IFRS Foundation partner on sustainability reporting interoperability. |

| Net Zero Frameworks | Science Based Targets initiative (SBTi) announces major revision plans for the Corporate Net-Zero Standard. |

| New Voluntary Disclosure Framework | The Taskforce on Inequality and Social-related Financial Disclosures (TISFD) is scheduled to officially launch in September. |

Key Insights

UK Legislation

The UK’s Sustainability Disclosure Requirements (SDR)

The UK Government has released a 2024 implementation Update on the Sustainability Disclosure Requirements (SDR), detailing several key announcements.

Background:

SDR is a cornerstone of the UK’s “Mobilising Green Investment: 2023 Green Finance Strategy,” providing investors and consumers with robust information for informed capital allocation. The UK Government is adopting ISSB Standards within the SDR and has developed a comprehensive sustainability disclosure framework to facilitate the endorsement and implementation process for these standards.

The key updates:

Name change:

The UK Sustainability Disclosure Standards (SDS) are now known as UK Sustainability Reporting Standards (SRS), aligning more closely with EU ESRS.

UK SRS:

The Government aims to make the UK-endorsed ISSB standards available in Q1 2025, pending a positive endorsement decision. Previously, the Government committed to endorsing the ISSB by July 2024.

In Q2 2025, following endorsement and consultation, the Financial Conduct Authority (FCA) can use the UK SRS to introduce sustainability reporting requirements for UK-listed companies. The Government will decide on disclosure requirements for UK companies outside the FCA’s regulatory scope following a similar process.

Any reporting changes will take effect no earlier than January 2026 due to the required legislative changes.

While the scope of companies outside the FCA regulatory requirements has not been announced, large private companies should use this time to upskill their senior teams on climate and sustainability risks and opportunities. They should also identify potential gaps in their risk management and governance systems. This will help them manage these issues effectively in the interim, prepare for future reporting requirements, and inform their business strategy, laying the groundwork for Transition planning (see below).

Transition Plan Disclosures:

The Transition Plan Taskforce (TPT) Disclosure Framework, launched by the UK Government in April 2022, strongly aligns with aspects of IFRS S2.

In Q2 2024, the Government will consult on effective transition plan disclosures for the UK’s largest companies as part of the Green Finance Strategy.

In 2025, the FCA will consult on enhancing its expectations for transition plan disclosures in line with the TPT Disclosure Framework and the IFRS S2.

Transition plan disclosure as a regulatory requirement may be reserved for the largest companies, however, businesses should be considering what risks and opportunities lie ahead during a climate transition. This thinking dovetails with the UK SRS requirements and acts as a fundamental next step to help businesses plan and prepare for a changing world so that they can protect their market share and grow in new environments of regulations, client demands, and physical conditions caused by climate change.

SDR & Investment Labels:

The FCA is currently consulting on extending the SDR and labelling regime to UK-based portfolio managers, open until 14 June 2024.

A consultation, led by the Government, on including funds under the Overseas Funds Regime (OFR) in the SDR is planned for Q3 2024, with potential legislation by 2025.

UK Green Taxonomy:

The Government is developing the UK Green Taxonomy, with consultations expected in due course. A two-year voluntary disclosure period will be introduced once the Taxonomy has been finalised. Although the Government has not yet specified which companies can report voluntarily, it stated in the ‘Mobilising Green Investment: 2023 Green Finance Strategy’ report that it aims to avoid burdening companies for whom disclosing taxonomy-related information would be unreasonable due to their size and scale. Therefore, it will develop proposals that consider proportionality.

Nature-related Disclosures:

The Government supports initiatives like the Taskforce on Nature-related Financial Disclosures (TNFD) and encourages ISSB to consider TNFD’s holistic risk management in future standards. There are currently no explicit plans to integrate TNFD within the UK SRS and the Government will likely follow ISSB decisions.

These updates reflect the UK Government’s commitment to enhancing transparency and accountability in sustainability reporting, aligning with international standards and fostering green investment.

UK Financial Conduct Authority (FCA)

The anti-greenwashing rule became effective on 31st May. Under this rule, firms must now ensure that all communications to UK individuals about the sustainability characteristics of financial products and services are:

- Aligned with the actual sustainability characteristics of the product or service.

- Fair, clear and not misleading.

The rule applies to:

- All firms, irrespective of their coverage under other aspects of the FCA’s Sustainability Disclosure Requirements and the client categorisation of UK investors.

- All communications about financial products or services referring to environmental and/or social characteristics, including marketing documents, ESG reports, and in-person communications.

- The approval of financial promotions by unauthorised persons for communication in the UK.

The FCA published detailed guidance on implementing the anti-greenwashing rule last month. For key insights, please refer to Acclaro’s April newsletter.

EU Legislation

ESMA publishes Final Guidelines for ESG and Sustainability-Related Fund Names

On the 14th May 2024, the European Securities and Market Authority (ESMA) issued its final report on the “Guidelines on funds’ names using ESG or sustainability-related terms”. These guidelines align with the Sustainable Finance Disclosure Regulation (SFDR) and should apply to EU fund managers and non-EU fund managers marketing EU or non-EU funds in the European Economic Area.

The key points are:

- Fund names using ESG or sustainability-related terms must meet certain minimum requirements, such as a specified percentage commitment to promoting environmental and/or social characteristics or making sustainable investments and adhering to an exclusion list.

- There are no exemptions; the guidelines apply to funds that have had a final closing before the rules take effect, with an additional six-month transition period from the effective date.

- The guidelines are not mandatory; national regulatory authorities in the EU may choose whether to implement them forward.

Financial Institutions should therefore review the guidelines to ensure that those funds marketed in the EEA are marketed in line with the guidelines.

Sustainable Finance Disclosure Regulation (SFDR) publishes summary report after a consultation on the implementation of SFDR and Article 8 and 9 fund classifications

On the 3rd May 2024, the EU released a summary report after a 3-month consultation with stakeholders regarding the implementation of Sustainable Finance Disclosure Regulation (SDFR) and the classification of Article 8 and 9 funds.

The SFDR, in effect since March 2021, aims to prevent greenwashing and support the EU’s Green Deal to achieve carbon neutrality by 2050. However, confusion has persisted, particularly in classifying sustainable funds as Article 8 (“light green” funds) or Article 9 (“dark green”).

Key findings from the consultation feedback report include:

- 89% of respondents believe that enhancing transparency through sustainability-related disclosures in the financial sector remains essential.

- 77% of respondents highlighted a lack of legal clarity regarding key concepts, the limited relevance of certain disclosure requirements and issues related to data availability as significant framework limitations.

- Despite the confusion around fund classifications, there was no consensus on whether to revise the split between Articles 8 and 9 or to convert them into formal product categories with clarified criteria.

As the EU revisits SFDR, it must consider the legislation’s policy objective and how to tailor it to achieve the intended impacts.

Corporate Sustainability Due Diligence Directive (CSDDD)

On the 24th May, the EU officially approved the Corporate Sustainability Due Diligence (CSDDD) during COMPET Council meeting. The CSDDD mandates that large companies undertake environmental and human rights due diligence measures within their operations and across their global supply chains.

The approval process faced several adjustments:

- Weakened rules for the financial sector’s downstream value chain.

- Reduced coverage to companies with 1000+ employees and a net worldwide turnover exceeding €450 million.

- Removed obligations concerning consumption and disposal in the downstream value chain.

- Excluded the Paris Agreement from due diligence obligations.

Next Steps:

- The CSDDD will be published in the EU Journal in approximately 6 weeks.

- It will take effect 20 days after publication.

- EU Member states have two years to transpose the directive into national legislation, with the opportunity to enforce stricter requirements.

- European Commission will provide implementation guidance, detailing key aspects of the law.

- Large companies will have 3-5 years to comply, depending on their size. For example, companies with more than 5000 employees and a turnover of €1,500 million will face initial compliance requirements in 2027 while those with 3000 employees and a turnover of €900 million will be affected in 2028.

- Companies must enhance their due diligence system, align standards with CSDDD, scaling due diligence across the value chain, train suppliers, and improve stakeholder engagement.

CSRD’s publication of its sustainability reporting standards delayed

The deadline for the EU Commission to publish specific reporting standards under the EU Corporate Sustainability Reporting Directive (CSRD) has been extended from the 30th June 2024 to the 30th June 2026.

The European Commission is tasked with adopting delegated regulations that detail the standards companies must use for sustainability disclosures under the CSRD. The first of these, the general standards, were adopted in July 2023.

By the 30th June 2026, the Commission must now adopt the sector-specific standards and the general reporting standards for third-country parent consolidated reporting. Companies will be subject to the third-country parent consolidated reporting obligation if they are EU subsidiaries or branches of non-EU entities meeting certain size thresholds and if the parent entity’s group has a substantial turnover in the EU.

The requirement for EU subsidiaries and branches to report according to the standards set by the Commission remains unchanged and will apply from financial years beginning on or after the 1st January 2028.

International Reporting Standards

International Financial Reporting Standards (IFRS) Foundation and European Financial Reporting Advisory Group (EFRAG) publish interoperability guidance

The IFRS Foundation and EFRAG have jointly released guidance to illustrate the substantial alignment achieved between the International Sustainability Standards Board’s IFRS Sustainability Disclosure Standards (ISSB Standards) and the European Sustainability Reporting Standards (ESRS). This guidance offers comprehensive analysis, particularly focusing on climate-related disclosures, to demonstrate how companies can effectively apply both sets of standards.

This practical support aims to streamline compliance efforts for companies, addressing complexities, fragmentation, and potential duplications arising from applying both ISSB Standards and ESRS. As global mandates for sustainability-related disclosures through these standards increase, EFRAG and the ISSB are dedicated to fostering efficiencies to enhance transparency, comparability, and accountability.

Companies adopting this guidance will gain improved capabilities in collecting, governing, and managing decision-useful data. Specifically, the guidance outlines the alignment of general requirements, encompassing key concepts such as materiality, presentation, and disclosures for sustainability topics beyond climate. Additionally, it furnishes insights into aligning climate disclosures and equips companies with essential information to ensure compliance with both sets of standards, regardless of their initial choice.

This guidance is relevant for larger companies that adhere to both the European reporting regulations, including the EU Corporate Sustainability Reporting Directive (CSRD), which incorporates the ESRS as well as needing to adopt ISSB standards for voluntary or regulatory report (such as the UK SRS in 2025).

GRI and IFRS Foundation partner on sustainability reporting interoperability

The Global Reporting Initiative (GRI) and the International Financial Reporting Standards (IFRS) are working together to enhance the integration of their standards, enabling comprehensive reporting on an organisation’s impacts, risks and opportunities, including risks stemming from the organisation’s own impact. This collaboration builds upon the Memorandum of Understanding signed in 2022.

This partnership aims to deliver consistent, detailed global sustainability reporting that meets the information demands of both investors and a broader range of stakeholders.

The International Sustainability Standards Board (ISSB) and the Global Sustainability Standards Board (GSSB) have committed to identifying and aligning common disclosures that address information requirements of their respective standards, both thematic and standard-based.

One of the first outcomes of this collaboration will be a pilot methodology pilot based on the recently published GRI 101 Biodiversity Standard and the ISSB’s forthcoming project on Biodiversity, Ecosystems and Ecosystem Services.

The ISSB and the GSSB will continue to make decisions independently following their established standard-setting due processes.

This upcoming guidance will be valuable for companies that report under GRI standards and operate in countries, such as the UK, that are adopting ISSB standards.

Net Zero Frameworks

SBTi announces major revision plans for the Corporate Net-Zero Standard

The Science Based Targets initiative (SBTi) has published the Terms of Reference for Corporate Net-Zero Standard Version 2.0, outlining the objectives, scope, deliverables, timeline, and opportunities for engagement during the revision process.

The Corporate Net-Zero Standard Version 2.0 will be developed according to the Standard Operating Procedure (SOP) for the Development of SBTi Standards, which mandates a review every two to five years. To facilitate stakeholder input, the SBTi has also provided a Project Feedback Form for submitting feedback throughout the revision.

The SBTi’s review of the Corporate Net-Zero Standard focuses on four main goals:

- Aligning with the latest scientific insights and best practices, such as those from the IPCC and the UN Secretary General’s High-Level Expert Group (HLEG) on net-zero commitments of non-state entities.

- Addressing challenges in setting and implementing scope 3 targets.

- Incorporating continuous improvement and target achievement.

- Improving the structure and compatibility of the standard with other SBTi standards and relevant external frameworks.

According to the SBTi, many companies with validated science-based targets are nearing the end of their first target cycle in 2025. The Corporate Net-Zero Standard will explore key elements to facilitate a progress review at the end of the target period and ensure a robust re-validation process regularly.

The SBTi also states comprehensive details to assist entities with validated targets, targets under validation, or active commitments in preparing for conformity to the Corporate Net-Zero Standard V2.0 will be provided promptly before its launch.

The Corporate Net-Zero Standard V2.0 is expected to be published in Q4 2025.

New Voluntary Disclosure Framework

Taskforce on Inequality and Social-related Financial Disclosures (TISFD) launch date announced

The official launch of the Taskforce on Inequality and Social-related Financial Disclosures (TISFD) is scheduled for September 2024. The TISFD emerged from the merger between the Taskforce on Inequality-related Financial Disclosures (TIFD) and the Taskforce on Social-related Financial Disclosures (TSFD).

The TISFD’s primary objective is to establish a comprehensive global framework for disclosing inequality and social-related factors. The framework hopes to enable companies to communicate their impacts, dependencies, and opportunities more effectively regarding inequality and social-related matters. In alignment with the TCFD, TNFD and ISSB framework, it is anticipated that areas of coverage within the framework include governance, strategy, and management processes.

The initiative seeks to meet the growing demands of regulators, capital providers, companies and civil society and labour organisations for assessing the material financial risks businesses face due to inequality and social issues. By giving clarity through disclosure on company and investors impact on people and how the inequalities affect a business it aims to enhance the stability of financial systems, address systemic risks posed by inequality, and improve outcomes for everyone.

As a voluntary framework, the TISFD will be open to all sizes of company and sectors and target investors in a similar way to the TCFD framework focused on climate. A broad range of civil society groups, investors, businesses, financial institutions, academics and governmental organisations are engaged with the TISFD Working Group to support the initiative’s development ahead of its launch in September 2024. Businesses that identify a material linked with people and inequality may want to keep an eye on the development of this framework. There will be no links with Government regulation, but stakeholders may be interested which will drive the need for information from businesses.

To stay informed about TISFD developments and support its launch, organisations are encouraged to become TISFD Supporters. Interested organisations can express their interest by completing a form available on the TISFD website.

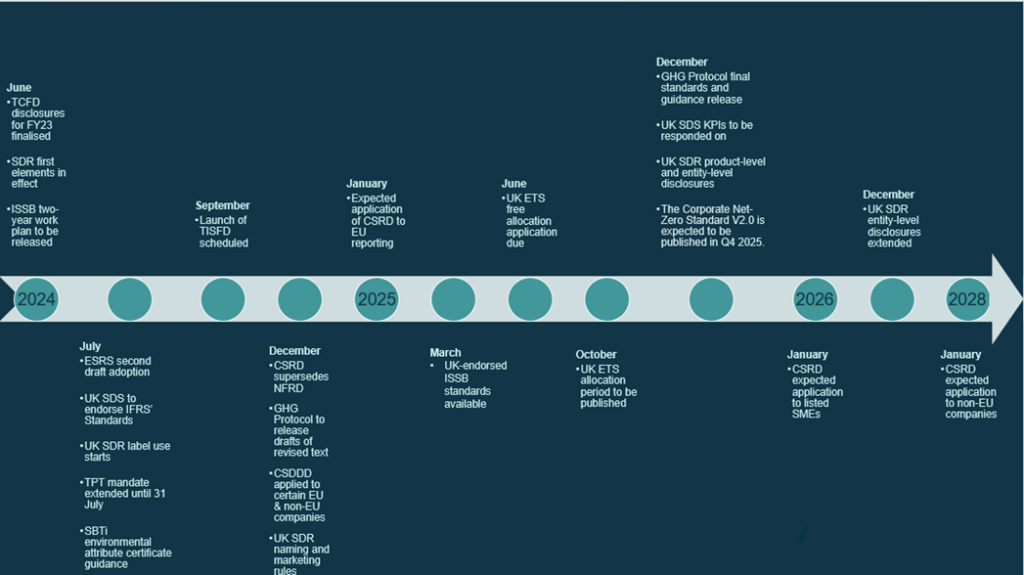

Horizon Scanning

| Date expected | Framework | Description |

|---|---|---|

| June 2024 | TCFD | FCA ESG Rules: TCFD disclosures relating to Financial Year 2023 to be finalised |

| June 2024 | UK SDR | First elements of the new rules (excluding anti-greenwashing rule) to come into force – at the earliest |

| June 2024 | ISSB | Two-year work plan release expected |

| July 2024 | ESRS | Anticipated adoption of the second draft of ESRS |

| July 2024 | UK SDR | Firms can begin to use labels, with accompanying disclosures from 31 July |

| July 2024 | TPT | TPT’s mandate extended until at least 31 July, in order to support the Transition Finance Market Review. |

| July 2024 | SBTi | First draft of detailed guidance on using environmental attribute certificates for Scope 3 emissions reduction |

| September 2024 | TISFD | Launch of TISFD scheduled. |

| December 2024 | UK SDR | Naming and marketing rules come into force, with accompanying disclosures, from 2 December |

| 2024 | CSRD | Due to supersede NFRD in 2024. Large companies already subject to NFRD must begin reporting on the fiscal year 2024. Drafting of sectoral-ESRS. |

| 2024 | CSDDD | Application of CSDDD to certain EU and non-EU companies expected to begin at some stage in 2024 |

| 2024 | GHG Protocol | Expected to release drafts of revised text |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| June 2025 | UK ETS | The window for operators of installations to apply for free allocation, or to be in the schemes for hospital or small emitters or for ultra-small emitters, in the 2026-2030 allocation period is 1 April – 30 June 2025. |

| October 2025 | UK ETS | Hospitals or small emitters and ultra-small emitters for the 2026-2030 allocation period must be published by 17 October 2025 |

| December 2025 | UK SDR | Ongoing product-level and entity-level disclosures for firms with AUM>£50bn, from 2 December |

| December 2025 | SBTi | The Corporate Net-Zero Standard V2.0 is expected to be published in Q4 2025. |

| March 2025 | UK SDR | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SRS |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| February 2026 | UK ETS | Date before which the allocation table for the 2026-2030 allocation period must be published is 28 February 2026 |

| June 2026 | CSRD | Sector-specific standards to be published under the EU CSRD. |

| December 2026 | UK SDR | Entity-level disclosure rules extended to firms with AUM>£5bn, from 2 December |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

Funding

In its Autumn Statement 2022, the UK Government announced a new, long-term commitment to enhance energy efficiency, aiming to drive down costs for households, businesses, and the public sector with the end goal being a 15% reduction in the UK’s final energy consumption from buildings and industry by 2030 compared to 2021 levels.

This commitment took the form of new government funding worth £6 billion being made available from 2025 to 2028. These funds have recently been earmarked, in a government press statement on December 18, 2023, for various schemes aimed at delivering energy efficiency assistance to businesses and homes throughout the United Kingdom. Some of these schemes are new, while some are existing schemes that have been allocated more funding.

| Scheme | Allocation | Description | Years of funding in the next spending review period |

|---|---|---|---|

| Boiler Upgrade Scheme | £1.545bn | Replacing fossil fuel heating systems | 2025/2026 – 2027/2028 |

| Heat Pump Investment Accelerator | £15m | Bringing forward investment in the UK heat pump manufacturing supply chain | 2025/2026 |

| New £400m energy efficiency grant | £400m | For households in England to make changes such as bigger radiators or better insulation | 2025/2026 – 2027/2028 |

| New local authority retrofit scheme | £500m | Supporting low-income and cold homes with measures such as insulation | 2025/2026 – 2027/2028 |

| Social Housing Decarbonisation Fund | £1.253bn | Supporting social homes to be insulated or retrofitted | 2025/2026 – 2027/2028 |

| Green Heat Network Fund[1] | £485m | Helping homes and buildings access low carbon, affordable heating | 2025/2026 – 2027/2028 |

| Heat Network Efficiency Scheme[1] | £45m | Improving around 100 existing heat networks | 2025/2026 – 2027/2028 |

| Public Sector Decarbonisation Scheme | £1.17bn | Providing grants for public sector bodies to fund heat decarbonisation and energy efficiency measures | 2025/2026 – 2027/2028 |

| Industrial Energy Transformation Fund | £225m | Continuing to help businesses transition to a low-carbon future | 2025/2026 – 2027/2028 |

| Industrial Energy Efficiency and decarbonisation support | £410m | Further details to be announced in due course | 2025/2026 – 2027/2028 |

Sustainability Acronyms & Abbreviations

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESOS – Energy Savings Opportunity Scheme

ESRS – European Sustainability Reporting Standards

FCA – Financial Conduct Authority

GHG Protocol – Greenhouse Gas Protocol

GRI – Global Reporting Initiative

GSSB – Global Sustainability Standards Board

IETA – International Emissions Trading Association

ISSB – International Sustainability Standards Board

MESOS – Manage your Energy Savings Opportunity Scheme

SBTi – Science-Based Targets Initiative

SDFR – Sustainable Finance Disclosure Regulation

TCFD – Taskforce for Climate Related Disclosure

TISFD – Taskforce on Inequality and Social-related Financial Disclosures

TPT – Transition Plan Taskforce

UK ETS – UK Emissions Trading Scheme

UK SDR – Sustainability Disclosure Requirements

UK SDS – Sustainability Disclosure Standards

US SEC – Securities and Exchange Commission