ESG Policies and Regulations Update June 2024

Keeping pace with net zero policies and regulation changes can pose a challenge. Our monthly updates are designed to provide you with the necessary support and guidance through the intricate landscape of ESG policies. We deliver the latest updates and significant developments concerning key sustainability frameworks, regulations, and standards from across the UK, EU, and US, and delve into further detail on what you need to know.

In this month’s edition, we delve into the European Supervisory Authorities’ proposed enhancements to the SFDR, focusing on the reclassification of sustainability-focused investment funds. We also examine the European Council’s agreed position on the new Green Claims Directive. Additionally, we remind readers that the CDP questionnaire is now open for responses and highlight some of the key changes to expect in the 2024 questionnaire.

June update

| Framework | Update |

|---|---|

| EU Legislation | The European Securities and Market AuThe European Supervisory Authorities (ESA) publish final greenwashing report. The European Supervisory Authorities (ESA) propose new updates and changes to the Sustainable Finance Disclosure Regulations (SFDR). The European Council has established its negotiating position on the new Green Claims Directive, moving closer to regulating greenwashing by businesses. The European Council formally adopts EU Nature Restoration law. |

| International Reporting Standards | EFRAG and TNFD Release TNFD-ESRS Correspondence Mapping Guidance. The ISSB announces its commitment to further harmonise the sustainability reporting landscape as it embarks on its new 2-year work plan. |

| Voluntary Disclosure Framework | The CDP Corporate Questionnaire is open for disclosers to respond. The Global Reporting Initiative (GRI) announces updates to its labour-related standards. |

Subscribe to newsletter

Receive our regulatory updates along with relevant news and insights in our monthly newsletters

Key Insights

EU Legislation

ESA publish final greenwashing report

The three European Supervisory Authorities (ESA), which comprise the European Securities and Markets Authority (ESMA), The European Banking Authority (EBA) and the European Insurance and Occupational Pensions Authority (EIOPA), have individually released their final reports on greenwashing in the financial sector. These reports adopt a coordinated approach to tackling greenwashing risks, detailing the current supervisory actions taken by each authority and reinforcing a mutual comprehension of greenwashing. Each report offers a future-oriented perspective on improving sustainability-related supervision in the years ahead.

Key findings from the ESMA report:

- National Competent Authorities (NCAs): NCAs are currently prioritising the supervision of sustainability-related claims by improving monitoring and detection of greenwashing to critically scrutinize such claims across various sectors.

- Resource enhancement: NCAs are encouraged to bolster their human resources and expertise, invest in supervisory tools like SupTech solutions, and further incorporate greenwashing risks into their supervisory work programs to enhance scrutiny of sustainability-related claims.

- Support and guidance: ESMA will maintain its efforts in monitoring of greenwashing risks, utilising SupTech tools, and enhancing capacity building. Additionally, ESMA will initiate Common Supervisory Actions where necessary and may provide further guidance for market participants and supervisors in high-risk areas.

- European Commission Role: The European Commission is encouraged to strengthen the mandates of NCAs and ESMA in specific areas, such as benchmarks, and ensure all NCAs have the authority to promote financial education for retail investors. The Commission should also ensure the legislative framework supports NCAs’ access to necessary data.

Although the ESA reports primarily focus on the EU’s financial sector, tackling greenwashing effectively demands worldwide collaboration among financial supervisors and the development of interoperable standards for sustainability disclosures. To reduce unintentional greenwashing risks that companies may face in this complex and changing regulatory environment, it is crucial to understand the relevant regulations and requirements.

ESA Propose new updates and changes to the Sustainable Finance Disclosure Regulations

The European Supervisory Authorities (ESA), announced the publication of a new assessment of the Sustainable Finance Disclosure Regulations (SFDR), following the comprehensive review conducted by the European Commission last year.

The SFDR currently delineates investment funds aimed at sustainability into different categories, each with varying disclosure obligations. Concerns have been raised regarding Article 8 (“light green”) funds that “promote environmental or social characteristics or a combination of those characteristics” and the more stringent Article 9 (“dark green”) funds “which have sustainable investment as their objective”. The commission noted that these classifications may be being used as unofficial sustainability quality labels, potentially leading to greenwashing risks and market confusion.

To address these issues, the ESAs propose updates, including the introduction of new “Sustainable” and “Transition” categories for financial products such as investment funds, life insurance and pension products. They also suggest an indicator to understand a product’s sustainability profile better.

The “Sustainable” category would encompass products investing in environmentally or socially sustainable activities or assets, requiring compliance with minimum thresholds, such as alignment with the EU Taxonomy for environmentally sustainable products. The “Transition” category would include products investing in activities or assets that are not yet sustainable but aim to become so over time, with a pathway aligned with EU and global environmental and social objectives.

The proposed sustainability indicator would grade financial products on a scale, simplifying complex sustainability information.

Disclosure and marketing proposals include requirements for products with sustainability features that do not qualify for the “Sustainable” or “Transition” categories to disclose these features in regulatory documents and restrict the use of ESG or sustainability-related terms. Products without sustainability features should not use ESG or sustainability-related terms and must include disclaimers, potentially requiring minimal disclosure of their negative sustainability impacts.

The ESA also highlight consumer confusion between the SFDR and the EU Taxonomy, suggesting that the taxonomy could serve as a science-based reference point for measuring sustainability performance.

Although these proposals are part of the ESAs’ initial assessment of the SFDR, it is crucial for companies to be aware of the evolving financial disclosure requirements in the EU. This update indicates that the ESAs are moving towards more stringent and transparent disclosure regulations. Companies in the financial sector should take steps to eliminate greenwashing risks and ensure accurate and transparent sustainability disclosures.

The European Council has established its negotiating position on the new Green Claims Directive, moving closer to regulating greenwashing by businesses

The EU Council has announced its agreement on the European Commission’s Green Claims Directive. Introduced in March 2023, this directive aims to provide consumers with reliable and verifiable environmental information. It complements the recently enacted Directive on Consumers for the Green Transition (Empowering Consumers Directive or ECD), which targets broader claims like ‘eco-friendly’ to protect consumers from greenwashing.

The adopted Council stance offers a significant glimpse into the final directive, though modifications may arise throughout the negotiation process (as was seen in the recently adopted Corporate Sustainability Due Diligence Directive (CSDDD)).

The directive currently establishes minimum requirements for the substantiation, communication and verification of explicit environmental claims. The Council suggest that companies should rely on clear criteria and the latest scientific evidence to substantiate their claims and labels. Environmental claims and labels need to be clear and easy to understand, explicitly indicating the environmental attributes they represent. All green claims will need to be verified by independent third-party experts before publication.

The Council aims to limit the proliferation of green labels that identify products as more environmentally sustainable than their competitors. For new and existing eco-labels to be valid, they must meet Commission requirements for transparency, dispute resolution, and non-compliance.

A significant proposed change to the directive involves carbon credits and their use in climate-related claims. The Council calls for detailed disclosure on carbon credit use, including the type and quantity of credits and whether they relate to emission reductions or removals. The directive distinguishes between contribution claims (using carbon credits to support climate action) and offset claims (using carbon credits to balance out emissions). For offset claims, companies must demonstrate a net-zero target, show progress towards decarbonisation, and specify the percentage of total greenhouse gas emissions offset. These changes aim to enhance the credibility of carbon-related claims by setting clear requirements.

The Council’s position will shape negotiations with the European Parliament to finalise the directive’s language, with discussions set to begin in the next legislative session. Once adopted, the directive will apply to all businesses operating within the EU, including small and medium-sized enterprises (SMEs) and microenterprises. However, the current proposal allows for a 14-month delay in implementation for SMEs.

The recent EU elections, which shifted the Parliament to the right, add uncertainty to the process. There have been calls to ease the regulatory burden on SMEs, and the recent Corporate Sustainability Due Diligence Directive indicates that the Green Claims Directive might see substantial revisions before it is finalised.

The European Council formally adopts EU Nature Restoration law

On June 17th, the European Council formally adopted the nature restoration regulation. First proposed in June 2022 under the EU biodiversity strategy, this law aims to restore at least 20% of the EU’s land and sea areas by 2030 and all ecosystems in need of restoration by 2050. It also seeks to mitigate climate change and the effects of natural disasters.

The law sets specific, legally binding targets and obligations for the restoration of various ecosystems, including terrestrial, marine, freshwater, and urban areas. Until 2030, restoration efforts will focus on Natura 2000 sites.

This regulation applies directly to all member states. While not directly applicable to corporates, it will affect future policy on an EU national level. EU countries must submit National Restoration Plans to the Commission within two years of the regulation’s enforcement, by mid-2026, detailing how they will achieve the targets. This means that individual countries may target specific sectors with requirements, or incentivise sectors to help achieve the plans. They are also required to monitor and report their progress, with the European Environment Agency producing regular technical reports to track compliance.

Given that over 80% of European habitats are in poor condition and past restoration efforts have often failed, this law is particularly important. The regulation will soon be published in the EU’s Official Journal and take effect.

By 2033, the Commission will review the regulation’s implementation and its impact on the agricultural, fisheries, and forestry sectors, as well as its broader socio-economic effects.

International Reporting Standards

EFRAG and TNFD Release TNFD-ESRS Correspondence Mapping Guidance

The Taskforce on Nature-related Financial Disclosures (TNFD) and the European Financial Reporting Advisory Group (EFRAG) have realised a guidance document titled TNFD-ESRS Correspondence Mapping. This document aims to help companies reporting on nature and biodiversity-related information by clarifying overlaps between the European Sustainability Reporting Standards (ESRS) and the TNFD’s disclosure recommendations.

The guidance provides a comprehensive mapping of the disclosures and key metrics recommended by the TNFD and required by the ESRS, highlighting the areas of alignment between the two standards and regulations. Over the past 2 years, TNFD and EFRAG have worked closely together to ensure consistency between their frameworks and they plan to continue this collaboration.

Key commonalities outlined in the document include:

- The alignment of 14 TNFD recommended disclosures with corresponding ESRS.

- The TNFD support for the double materiality approach mandated by the ESRS as a recommended method for assessing materiality.

- The option for companies, under the ESRS, to use the TNFD’s LEAP approach for identifying and evaluating nature-related issues when conducting materiality assessments on environmental topics beyond climate change.

This guidance is particularly relevant for companies seeking to advance their transparency and reporting on nature-related issues, as well as having to comply with European reporting regulations such as the EU Corporate Sustainability Reporting Directive (CSRD), which incorporates the ESRS.

The ISSB announces its commitment to further harmonise the sustainability reporting landscape as it embarks on its new 2-year work plan

In June, the International Financial Reporting Standards (IFRS) Foundation announced its commitment to further harmonise the sustainability reporting landscape as the International Sustainability Standards Board (ISSB) begins its new two-year work plan and publishes a feedback statement on this plan. The ISSB is focused on creating a global baseline for high-quality sustainability-related financial disclosures to meet investor demands for comparable, transparent and reliable sustainability reporting. The feedback report outlines stakeholders’ input on the strategic direction and balance of activities for the ISSB’s 2024-2026 work plan, including research projects added and omitted.

The ISSB aims to simplify the landscape of sustainability reporting by integrating multiple sources of initiatives. Over the next two years, the ISSB plans to enhance the harmonisation and consolidation of disclosure practices to meet market demands. This will be achieved through several key strategies:

- The IFRS Foundation will assume responsibility for the disclosure-specific materials from the Transition Plan Taskforce, using them to develop educational resources without altering the IFRS S2 requirements. These materials will be considered by the ISSB for potential enhancements in the IFRS S2 application guidance.

- To maintain compatibility with the GHG Protocol’s standards for measuring greenhouse gas emissions, the IFRS Foundation and GHG Protocol have signed a Memorandum of Understanding. This agreement establishes governance arrangements ensuring the ISSB’s active involvement in updates and decisions regarding GHG Protocol standards and guidance.

- The ISSB will collaborate with CDP to ensure alignment, with CDP’s 2024 questionnaire being based on IFRS S2 as the foundational baseline for climate disclosure.

- Full interoperability with the Global Reporting Initiative (GRI) will be achieved. Following the announcement in May 2024, the ISSB and GRI’s Global Sustainability Standards Board (GSSB) have pledged to identify and align common disclosures that meet the distinct requirements of their respective standards, both thematically and sector based.

- As highlighted in the ISSB’s feedback statement, the ISSB will explore building on initiatives such as the Taskforce on Nature-related Financial Disclosures (TNFD) to address investors’ information needs. This approach will be particularly emphasised in its new research projects on biodiversity, ecosystems, and ecosystem services, which were announced last month.

Voluntary Disclosure Framework

CDP Corporate Questionnaire is open for disclosers to respond

CDP, the most widely adopted voluntary sustainability reporting framework, has opened its new Corporate questionnaire, enabling disclosers to begin reporting their environmental impacts.

In February 2024, CDP released two documents outlining the key changes for the new 2024 questionnaire. These adaptations streamline the disclosure process while providing a holistic approach to environmental reporting, enabling companies to better understand and assess their environmental dependencies, impacts, risks, and opportunities. The key changes are as follows:

- Integration of climate, water, and forest disclosures into a single questionnaire.

- Inclusion of biodiversity and plastic questions.

- A specific questionnaire for Small to Medium-sized Enterprises (SMEs).

- Alignment with the most relevant standards, such as IFRS 2.

CDP has also made changes to its platform, incorporating features such as accessible guidance and support throughout the disclosure process, and warning notifications to alert disclosers when data has been inputted incorrectly or mandatory questions have been missed. These modifications should minimise mistakes and support a more streamlined and efficient reporting process.

Investors, customers, and governments increasingly require companies to disclose their ESG impacts. Companies should plan for increased transparency and reporting criteria to meet investor and customer demands, secure access to capital, prepare for increasing compliance regulations, and enhance business efficiency. As CDP is the most heavily prescribed climate reporting standard globally, completing its questionnaire is a valuable starting point for companies beginning their disclosure journey.

Companies planning to complete the CDP questionnaire this year should prepare for early successful submission by collecting high-quality data, engaging with colleagues internally, and aligning responses with sustainability goals.

GRI announces updates to its labour-related standards

The Global Reporting Initiative (GRI), which provides one of the world’s most widely used sustainability reporting standards, has launched a new review of its labour-related standards. This review aims to enhance how companies report their impacts on workers and improve transparency in disclosing workplace labour and human rights.

The GRI’s review begins with consultations on three revised standards: “GRI 402: Labour/Management Relations,” “GRI 401: Employment,” and “GRI 202: Market Presence.” The proposed standards address employment factors such as non-standard employment types, data privacy, and hiring turnover metrics. Additional revisions pertain to employee conditions, policies, and practices, including remuneration issues, working hours, skills development, retention, gender pay gaps, and social protection.

GRI also plans to initiate two more consultations within the next year to discuss reporting on career development, workers’ rights, and protections, culminating in a total of 11 GRI Standards.

The GRI Reporting Standards apply to any organisation, regardless of size or sector. Companies already reporting or considering reporting to GRI standards are advised to familiarise themselves with the new and revised standards and identify potential gaps in current reporting practice compared to the new requirements. It is important for companies to determine where improvements or additional data collection will be needed.

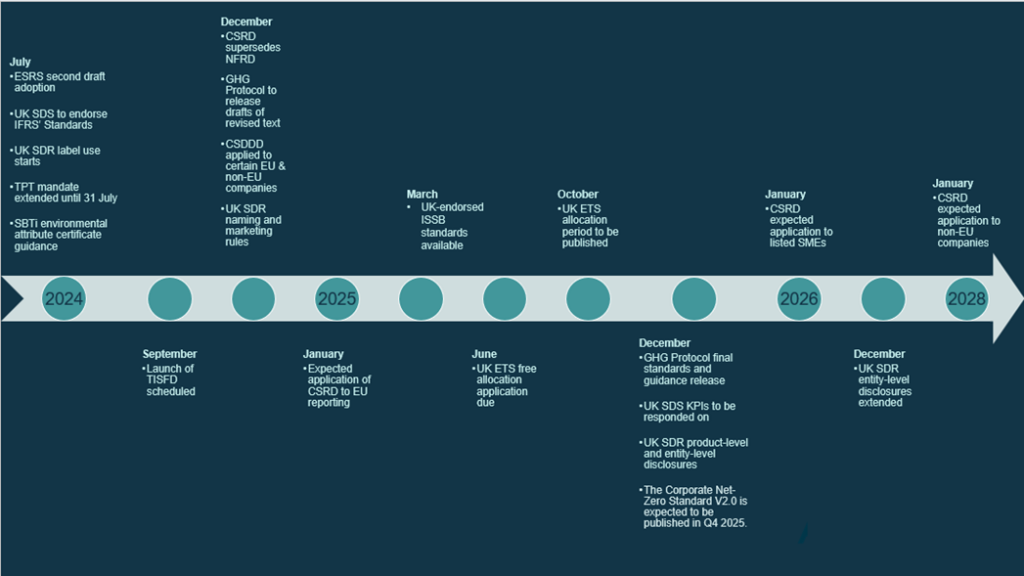

Horizon Scanning

| Date expected | Framework | Description |

|---|---|---|

| July 2024 | ESRS | Anticipated adoption of the second draft of ESRS |

| July 2024 | UK SDR | Firms can begin to use labels, with accompanying disclosures from 31 July |

| July 2024 | TPT | TPT’s mandate extended until at least 31 July, in order to support the Transition Finance Market Review. |

| July 2024 | SBTi | First draft of detailed guidance on using environmental attribute certificates for Scope 3 emissions reduction |

| September 2024 | TISFD | Launch of TISFD scheduled. |

| December 2024 | UK SDR | Naming and marketing rules come into force, with accompanying disclosures, from 2 December |

| 2024 | CSRD | Due to supersede NFRD in 2024. Large companies already subject to NFRD must begin reporting on the fiscal year 2024. Drafting of sectoral-ESRS. |

| 2024 | CSDDD | Application of CSDDD to certain EU and non-EU companies expected to begin at some stage in 2024 |

| 2024 | GHG Protocol | Expected to release drafts of revised text |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| June 2025 | UK ETS | The window for operators of installations to apply for free allocation, or to be in the schemes for hospital or small emitters or for ultra-small emitters, in the 2026-2030 allocation period is 1 April – 30 June 2025. |

| October 2025 | UK ETS | Hospitals or small emitters and ultra-small emitters for the 2026-2030 allocation period must be published by 17 October 2025 |

| December 2025 | UK SDR | Ongoing product-level and entity-level disclosures for firms with AUM>£50bn, from 2 December |

| December 2025 | SBTi | The Corporate Net-Zero Standard V2.0 is expected to be published in Q4 2025. |

| March 2025 | UK SDR | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SRS |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| February 2026 | UK ETS | Date before which the allocation table for the 2026-2030 allocation period must be published is 28 February 2026 |

| June 2026 | CSRD | Sector-specific standards to be published under the EU CSRD. |

| December 2026 | UK SDR | Entity-level disclosure rules extended to firms with AUM>£5bn, from 2 December |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

Funding

In its Autumn Statement 2022, the UK Government announced a new, long-term commitment to enhance energy efficiency, aiming to drive down costs for households, businesses, and the public sector with the end goal being a 15% reduction in the UK’s final energy consumption from buildings and industry by 2030 compared to 2021 levels.

This commitment took the form of new government funding worth £6 billion being made available from 2025 to 2028. These funds have recently been earmarked, in a government press statement on December 18, 2023, for various schemes aimed at delivering energy efficiency assistance to businesses and homes throughout the United Kingdom. Some of these schemes are new, while some are existing schemes that have been allocated more funding.

| Scheme | Allocation | Description | Years of funding in the next spending review period |

|---|---|---|---|

| Boiler Upgrade Scheme | £1.545bn | Replacing fossil fuel heating systems | 2025/2026 – 2027/2028 |

| Heat Pump Investment Accelerator | £15m | Bringing forward investment in the UK heat pump manufacturing supply chain | 2025/2026 |

| New £400m energy efficiency grant | £400m | For households in England to make changes such as bigger radiators or better insulation | 2025/2026 – 2027/2028 |

| New local authority retrofit scheme | £500m | Supporting low-income and cold homes with measures such as insulation | 2025/2026 – 2027/2028 |

| Social Housing Decarbonisation Fund | £1.253bn | Supporting social homes to be insulated or retrofitted | 2025/2026 – 2027/2028 |

| Green Heat Network Fund[1] | £485m | Helping homes and buildings access low carbon, affordable heating | 2025/2026 – 2027/2028 |

| Heat Network Efficiency Scheme[1] | £45m | Improving around 100 existing heat networks | 2025/2026 – 2027/2028 |

| Public Sector Decarbonisation Scheme | £1.17bn | Providing grants for public sector bodies to fund heat decarbonisation and energy efficiency measures | 2025/2026 – 2027/2028 |

| Industrial Energy Transformation Fund | £225m | Continuing to help businesses transition to a low-carbon future | 2025/2026 – 2027/2028 |

| Industrial Energy Efficiency and decarbonisation support | £410m | Further details to be announced in due course | 2025/2026 – 2027/2028 |

Sustainability Acronyms & Abbreviations

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESOS – Energy Savings Opportunity Scheme

ESRS – European Sustainability Reporting Standards

FCA – Financial Conduct Authority

GHG Protocol – Greenhouse Gas Protocol

GRI – Global Reporting Initiative

GSSB – Global Sustainability Standards Board

IETA – International Emissions Trading Association

ISSB – International Sustainability Standards Board

MESOS – Manage your Energy Savings Opportunity Scheme

SBTi – Science-Based Targets Initiative

SDFR – Sustainable Finance Disclosure Regulation

TCFD – Taskforce for Climate Related Disclosure

TISFD – Taskforce on Inequality and Social-related Financial Disclosures

TPT – Transition Plan Taskforce

UK ETS – UK Emissions Trading Scheme

UK SDR – Sustainability Disclosure Requirements

UK SDS – Sustainability Disclosure Standards

US SEC – Securities and Exchange Commission