ESG Policies and Regulations Update July 2024

Keeping pace with net zero policies and regulation changes can pose a challenge. Our monthly updates are designed to provide you with the necessary support and guidance through the intricate landscape of ESG policies. We deliver the latest updates and significant developments concerning key sustainability frameworks, regulations, and standards from across the UK, EU, and US, and delve into further detail on what you need to know.

In this month’s edition, we spotlight several EU legislations taking effect this July, including the CSDDD, CSRD, and EU CBAM. We also delve into the TNFD and GFANZ’s upcoming consultations on nature and transition plans, as well as SBTi’s announcement to defer decisions on carbon offsetting until 2025 and the VCMI’s call for feedback on its Offsetting Guidelines for Corporate Scope 3 Targets.

July update

| Framework | Update |

|---|---|

| EU Legislation | CSDDD entered into force. CSRD was incorporated into national laws on the 6th July. EU CBAM: comes into effect from the 31st July. ESMA releases its “Opinion on the Sustainable Finance Regulatory Framework” |

| UK Legislation | UK SDR: Asset Managers Can Use Labels with Required Disclosures Starting 31st July |

| International Reporting Standards | ISSB set out draft changes to SASB standards. |

| Financial Disclosure Frameworks | The Institutional Investors Group on Climate Change (IIGCC) has updated their net-zero investment framework, shifting the focus away from financed emissions. Finance for Biodiversity updates nature target-setting framework for investors. |

| Voluntary Disclosure Framework | The Science Based Targets initiative (SBTi) has released two papers as an initial step in revising the SBTi Corporate Standard, deferring decisions on carbon offsetting until 2025. VCMI seeks input on Offsetting Guidelines for Corporate Scope 3 Targets. Both TNFD and GFANZ intend to launch individual consultations on nature and transition plans this year. TNFD Releases Additional Sector Guidance. |

Subscribe to newsletter

Receive our regulatory updates along with relevant news and insights in our monthly newsletters

Key Insights

EU Legislation

CSDDD entered into force

On the 25th July, the Corporate Sustainability Due Diligence Directive (CSDDD) officially entered into force, mandating companies to address their negative impacts on human rights and the environment.

The CSDDD requires companies to prevent, end, or mitigate potential or actual harm to human rights and the environment, such as child labour and biodiversity loss, and to remediate any actual adverse impacts caused. The compliance requirements include the implementation of due diligence processes, risks assessment and transparent reporting.

The regulation will be applied in stages based on a company’s turnover and employee count. The affected companies include:

- Large EU limited liability companies and partnerships: Approximately 6,000 companies with over 1,000 employees and more than EUR 450 million in net turnover worldwide.

- Large non-EU companies: Approximately 900 companies with over EUR 450 million in net turnover within the EU.

The directive includes provisions to ease compliance and limit the burden on companies, both within the scope and throughout the value chain. While SMEs are not directly covered, the directive provides supporting and protective measures for SMEs that might be indirectly affected as business partners in value chains.

Member States have two years to transpose it into national law and communicate the relevant texts to the Commission. The rules will start applying to companies one year later, with a gradual phase-in over 3 to 5 years. The Commission will issue guidelines to help companies conduct due diligence.

CSRD was incorporated into national laws on the 6th July

On the 6th July, EU Member States incorporated the CSRD into their national laws. The CSRD modernises and enhances the regulation surrounding social and environmental information companies must report, driving accountability and transparency.

The CSRD will be implemented in four main stages:

- Stage 1: Companies already under the Non-Financial Reporting Directive (NFRD) will comply starting 1st January 2024, with their first CSRD-compliant report due in 2025.

- Stage 2: Large companies not previously under NFRD must comply from 1st January 2025, with their first CSRD-compliant report due in 2026.

- Stage 3: Listed SMEs must comply from 1st January 2026, with first reports due in 2027. They may opt-out for the first two years by providing a statement explaining their inability to capture sustainability information.

- Stage 4: Non-EU companies with significant EU market presence must comply from 1st January 2028, with first reports due in 2029. This applies to companies operating directly in the EU or through a subsidiary or branch.

While the CSDDD focuses on due diligence regarding human rights and the environment, the CSRD emphasises transparency and reporting of sustainability efforts within the ESG framework. Together, the CSDDD and CSRD complement each other: the CSDDD establishes the action framework, and the CSRD ensures these actions are transparently reported in accordance with the latest sustainability and ESG standards.

Companies required to comply with the CSRD should start familiarising themselves with its mandatory reporting standards, the European Sustainability Reporting Standards. It is recommended that companies begin collecting data from their own operations, suppliers, and business partners to gather evidence for sustainability reports and establish a process for double materiality assessment.

EU CBAM: comes into effect from the 31st July

The EU’s Carbon Border Adjustment Mechanism (CBAM) entered its transitional phase on 1st October 2023. As a result, EU importers of steel, aluminium, cement, fertiliser, hydrogen, and electricity were required to submit their first quarterly reports detailing the embedded carbon emissions of their imports by 31st January 2024.

However, reports indicate that only a small number of European companies met this initial reporting deadline. Companies had to submit their CBAM reports by the 31st July 2024, to comply and avoid potential fines.

During the first three quarterly reporting periods (from 1st October 2023 to 31st July 2024), the EU permitted importers to use default values for emissions. For the remaining transitional period (from 1st July 2024 to 31st December 2025), importers must provide actual emission values, though estimated values can still be used for up to 20% of the total embedded emissions.

ESMA releases its “Opinion on the Sustainable Finance Regulatory Framework”

ESMA has released its “Opinion on the Sustainable Finance Regulatory Framework,” offering key recommendations to enhance investor access to sustainable investments and support the transition to a sustainable economy. These recommendations include:

- Basic Sustainability Disclosures: Implementing minimum sustainability disclosure requirements for all financial products to improve transparency and comparability.

- Regulation of ESG Data Products: Ensuring the reliability and comparability of ESG data by bringing ESG data providers under regulatory oversight.

- Investment Product Categories: Establishing clear categories for sustainable and transition investment products to aid investor understanding and selection.

These recommendations come in response to the European Commission’s review of the Sustainable Finance Disclosure Regulation (SFDR) and its request for input on greenwashing risks and supervisory challenges.

Key Points:

- Minimum disclosures could include key sustainability metrics such as greenhouse gas emissions, biodiversity impact, human rights, labour rights, and Taxonomy-alignment.

- New regulations like the CSRD will enhance transparency, but reliance on ESG data providers necessitates ensuring data quality.

- Companies should disclose revenue and capital expenditure linked to harmful activities undergoing transition or decommissioning.

- The creation of EU labels for “transition bonds” and defining transition investments is essential.

- A product categorisation system with science-based criteria and transparency obligations is recommended.

- The EU Taxonomy should be the primary reference for assessing sustainability, covering all significant economic activities and incorporating a social taxonomy.

ESMA aims to finalise these guidelines to ensure that investment in carbon credits and sustainable products effectively contributes to climate goals while preventing greenwashing.

UK Legislation

UK SDR: Firms Can Use Labels with Required Disclosures Starting 31st July

The UK’s Financial Conduct Authority (FCA) is rolling out a new framework called the Sustainability Disclosure Requirements (SDR), which will transform the evaluation, management, and disclosure of investment products. Three major changes take effect in 2024 (with two already in effect):

- Anti-Greenwashing Rule: Effective from 31st May 2024.

- Voluntary Labelling System: Effective from 31st July 2024.

- Sustainable Entity Reports: Effective from December 2025.

Voluntary Labelling System:

The SDR introduces four voluntary labels for asset managers to use for their products:

- Sustainability Focus: Assets selected for their environmental and/or social sustainability characteristics.

- Sustainability Improvers: Investments in assets with potential for significant improvements in environmental and/or social sustainability over time.

- Sustainability Impact: Products aiming to generate a measurable impact on specific environmental and/or social issues.

- Mixed Goals: Products combining elements of the above, investing in a mix of sustainable assets, improvement opportunities, and targeted impact initiatives.

Asset managers can choose to apply these labels to their products and use them in all client communications, provided they meet specific criteria related to investment strategy, reporting KPIs, governance and portfolio stewardship, and ongoing compliance and monitoring.

Managers must internally validate and document their adherence to these criteria and provide comprehensive disclosures to clients. This includes pre-investment information, ongoing updates, and general marketing materials.

While promoting products as “sustainable,” “green,” or “ESG” without a label is still possible, unlabelled funds must still meet disclosure requirements. This includes pre-contractual and ongoing reporting, along with an explanation from the manager for opting out of the labelling system.

International Reporting Standards

ISSB set out draft changes to SASB standards

The International Sustainability Standards Board (ISSB) aims to release exposure drafts for updates to the Sustainability Accounting Standards Board (SASB) in early 2025. SASB standards guide organisations in disclosing industry-specific sustainability risks and opportunities that may impact their cash flows, access to finance, or cost of capital over different time horizons.

The exposure draft development will proceed in two phases:

- Phase One: Focus on priority industry standards and related targeted amendments to other SASB standards.

- Phase Two: Address additional industry standards, cross-cutting projects, and other key gaps identified in Phase One.

Following their April 2024 research project announcement, ISSB will initiate two new research projects on biodiversity, ecosystems and ecosystem services, and human capital. This research will first gather evidence on investor interest, financial implications, existing standards, and current disclosure practices. ISSB will then analyse the findings to develop a framework of key concepts and evaluate the information provided through IFRS S1. This analysis will determine whether ISSB should proceed with standard-setting for these topics.

Financial Disclosure Frameworks

The Institutional Investors Group on Climate Change (IIGCC) has updated their net-zero investment framework, shifting the focus away from financed emissions.

The net-zero investment framework, first introduced in 2021, aims to support the net-zero commitments of the Glasgow Financial Alliance for Net Zero (GFANZ) and the Paris Aligned Asset Owners (PAAO). Its main goal is to serve as a comprehensive decarbonisation guide for the financial sector.

Recent updates to the framework encourage users to report their investments in climate solutions, transitional assets, or emerging market exposures. This enhancement allows users to more clearly demonstrate their contributions to real-world decarbonisation efforts.

Originally, the framework concentrated on reporting the financed emissions of portfolios and loan books. However, this focus raised concerns among hard-to-abate sectors, which feared it could limit their financing opportunities compared to companies that had already progressed in decarbonisation. These sectors require longer timelines and sustained financing to decarbonise. There were also worries that financing for providers of decarbonising solutions might decrease because their emissions could initially rise as their products scale up.

To address these issues, the revised guidance underscores that financial institutions involved in transition finance might see an initial increase in reported emissions from companies in these categories. Despite this, these companies play a vital role in achieving broader, economy-wide decarbonisation over time.

The updated framework also introduces new thematic sections for various asset classes, including sovereign bonds, real estate, and private debt, as well as advanced guidance for more sophisticated investors. Additionally, the IIGCC has strengthened its language on investor collaboration in response to antitrust concerns and political backlash, which previously led to notable exits from the GFANZ group and the dissolution of the Net Zero Insurance Alliance.

Finance for Biodiversity updates nature target-setting framework for investors

The Finance for Biodiversity (FfB) Foundation, established in 2021, has updated its nature target-setting framework for asset managers and owners. This guidance helps investors align financial flows with the Kunming-Montreal Global Biodiversity Framework to stop biodiversity loss by 2030. FfB aims to support financial institutions’ signatories in setting and reporting biodiversity targets by 2025. Signatories can become foundation members and join working groups.

Key updates include:

- Target reshuffle: Now, there are three types of targets—initiation, optional monitoring, and portfolio—replacing the previous four categories (initiation, sector, engagement and portfolio coverage). Initiation targets involve assessing and disclosing nature-related impacts, dependencies, risks and opportunities and setting governance targets. Monitoring targets focus on sector-specific KPIs and stewardship actions. Portfolio targets include setting sub-targets and stewardship sub-targets such as a percentage of firms from relevant sectors will have committed to setting validated Science-Based Targets for Nature by 2030 (sub-portfolio).

- Unified approach: The update removes separate tracks for beginners and advanced users, advocating a unified approach to achieve all targets by 2030, aligning with the Global Biodiversity Framework. Investors can still set shorter-term targets based on specific goals. The framework currently covers listed equity and corporate bonds, with plans to include other asset classes like sovereign debt in future updates. Guidance on setting positive impact targets is also planned.

- ENCORE update: The ENCORE tool (a tool which enables financial institutions to map their material impacts and dependencies on nature), launched in 2018, has expanded from 92 production processes to 271 economic activities, covering sectors like livestock farming and nuclear power production. It now includes key value chain links, helping users understand indirect nature-related impacts and dependencies. These updates aim to guide financial institutions towards sustainable decision-making for economies, consumers, and the planet.

The updates will enhance financial institutions’ understanding of nature’s impact on their operations. They should use the tool to make decisions that promote sustainability for economies, consumers, and the planet.

Voluntary Disclosure Framework

The Science Based Targets initiative (SBTi) has released two papers as an initial step in revising the SBTi Corporate Standard, deferring decisions on carbon offsetting until 2025.

After much anticipation, these publications delve into the use of carbon credits for offsetting emissions to achieve Scope 3 emission reduction targets as part of the process to update the Corporate Net-Zero Standard.

On April 9th, SBTi announced it might relax rules on ‘environmental attribute certificates,’ including carbon credits, to meet Scope 3 emission targets, with more information and clarity to be released in July.

However, the new reports do not indicate SBTi’s likely position on changes to the standards and are not to be expected until 2025 following further research and consultation.

Within the publications, the SBTi states there is no strong, conclusive evidence of the effectiveness of carbon offsetting. The synthesis report examines nature-based projects, renewable energy, and clean cookstoves, summarising extensive consultations with NGOs, academics, and businesses. The report flags studies that found only 12-33% of carbon credits provided their claimed climate benefits to corporate buyers and cites recurring issues such as over-crediting, lack of additionality, carbon leakage, and negative impacts on local communities.

These findings cast doubt on whether carbon offsetting can effectively meet reduction targets and global mitigation goals. However, the SBTi notes that Beyond Value Chain Mitigation (BVCM) is the preferred solution for delivering climate financing. BVCM involves investing in projects outside a company’s value chain that help avoid or reduce GHG emissions or remove GHG from the atmosphere.

Currently, the SBTi acknowledges that the findings are mixed, and that further work is needed to draw definitive conclusions. Nonetheless, current evidence suggests there is little scientific support for using carbon offsetting to effectively and reliably meet Scope 3 emission reduction targets.

VCMI Seeks Input on Offsetting Guidelines for Corporate Scope 3 Targets

The Voluntary Carbon Markets Integrity Initiative (VCMI) is seeking feedback on proposed guidelines for companies to purchase carbon credits to address unavoidable supply chain emissions.

In November 2023, the VCMI introduced a beta framework for Scope 3 claims, aiming to encourage corporate investment in carbon removal projects by providing clear guidelines. Now, the VCMI is launching a public consultation to gather opinions on using carbon market investments for Scope 3 emissions. The initiative stresses that carbon credits should only be used for emissions that cannot be otherwise mitigated and must represent real, verified reductions or removals. Additionally, these credits must adhere to strict environmental and social standards.

The current Scope 3 Claim framework includes restrictions, allowing companies to offset no more than 50% of their Scope 3 emissions with carbon credits, and only until 2035. The consultation, running from September to October, will gather input, with findings published in late 2024. The VCMI aims to finalise the Scope 3 Claim guidelines by early 2025.

This consultation also seeks to refine the methodology for Scope 3 claims and gather feedback on the established guardrails. The VCMI’s goal is to ensure that investment in carbon credits effectively contributes to climate mitigation and prevents greenwashing.

While efforts are underway to enhance the transparency and quality of available carbon credits, and while there is growing support for using offsets more flexibly for Scope 3 emissions, it is crucial that organisations view offsetting as a complement to, not a substitute for, direct decarbonisation measures.

TNFD and GFANZ intend to launch individual consultations on nature and transition plans this year.

At the end of 2023, both the Taskforce on Nature-related Financial Disclosures (TNFD) and the Glasgow Financial Alliance for Net Zero (GFANZ) planned initiatives to integrate nature considerations into climate transition plans.

The TNFD’s consultation will focus on defining what a nature transition plan should entail. It will assess how to manage the synergies and trade-offs between climate and nature and determine how these should be disclosed. The framework will encourage organisations to disclose the effects of nature-related dependencies, impacts, risks, and opportunities on their business models, value chains, strategies, and financial planning. This consultation will begin around the COP16 biodiversity conference in late October and conclude at the start of 2025. The final guidance on nature transition plans will be published in Q2 2025.

GFANZ’s consultation will explore how nature can be better integrated into its net-zero transition plan. It will address five themes and ten components of the net-zero transition plan framework (NZTP) and identify areas where additional guidance could help financial institutions incorporate nature considerations into their transition plans. GFANZ is collaborating with several organisations, including TNFD, to develop this guidance. Similar to TNFD, the consultation is scheduled to launch around COP16 and conclude by mid-January. GFANZ will then review the feedback and aims to publish voluntary supplemental guidance on incorporating nature into NZTP by the end of Q1.

TNFD Releases Additional Sector Guidance

Following an 18-month consultation with knowledge partners and market participants, the Taskforce on Nature-related Financial Disclosures (TNFD) has released its first set of Additional Sector Guidance. This includes guidance for eight real economy sectors and financial institutions, recommending sector-specific metrics for disclosure in line with TNFD’s September 2023 recommendations. The new guidance also covers nature-related issues across value chains.

The real economy sectors included are:

- Aquaculture

- Biotechnology and Pharmaceuticals

- Chemicals

- Electric Utilities and Power Generators

- Food and Agriculture

- Forestry and Paper

- Metals and Mining

- Oil and Gas

The financial institutions’ guidance includes recommended disclosures and metrics for banks, re/insurance companies, asset managers, owners, and development finance institutions.

Additionally, the value chain guidance explains how organisations can analyse upstream and downstream value chains, tackle challenges in assessing nature-related issues, and apply the TNFD’s LEAP approach to address these issues.

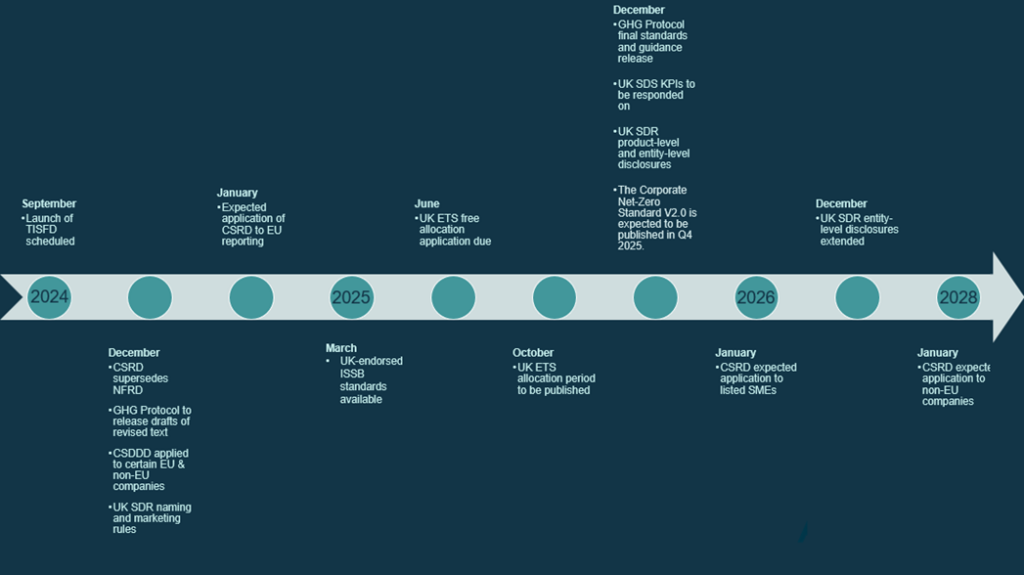

Horizon Scanning

| Date expected | Framework | Description |

|---|---|---|

| September 2024 | TISFD | Launch of TISFD scheduled. |

| October 2024 | ESRS | Anticipated adoption of the second draft of ESRS |

| December 2024 | UK SDR | Naming and marketing rules come into force, with accompanying disclosures, from 2 December |

| 2024 | ESRS | Anticipated adoption of the second draft of ESRS |

| 2024 | CSRD | Due to supersede NFRD in 2024. Large companies already subject to NFRD must begin reporting on the fiscal year 2024. Drafting of sectoral-ESRS. |

| 2024 | CSDDD | Application of CSDDD to certain EU and non-EU companies expected to begin at some stage in 2024 |

| 2024 | GHG Protocol | Expected to release drafts of revised text |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| June 2025 | UK ETS | The window for operators of installations to apply for free allocation, or to be in the schemes for hospital or small emitters or for ultra-small emitters, in the 2026-2030 allocation period is 1 April – 30 June 2025. |

| October 2025 | UK ETS | Hospitals or small emitters and ultra-small emitters for the 2026-2030 allocation period must be published by 17 October 2025 |

| December 2025 | UK SDR | Ongoing product-level and entity-level disclosures for firms with AUM>£50bn, from 2 December |

| December 2025 | SBTi | The Corporate Net-Zero Standard V2.0 is expected to be published in Q4 2025. |

| March 2025 | UK SDR | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SRS |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| February 2026 | UK ETS | Date before which the allocation table for the 2026-2030 allocation period must be published is 28 February 2026 |

| June 2026 | CSRD | Sector-specific standards to be published under the EU CSRD. |

| December 2026 | UK SDR | Entity-level disclosure rules extended to firms with AUM>£5bn, from 2 December |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

Funding

In its Autumn Statement 2022, the UK Government announced a new, long-term commitment to enhance energy efficiency, aiming to drive down costs for households, businesses, and the public sector with the end goal being a 15% reduction in the UK’s final energy consumption from buildings and industry by 2030 compared to 2021 levels.

This commitment took the form of new government funding worth £6 billion being made available from 2025 to 2028. These funds have recently been earmarked, in a government press statement on December 18, 2023, for various schemes aimed at delivering energy efficiency assistance to businesses and homes throughout the United Kingdom. Some of these schemes are new, while some are existing schemes that have been allocated more funding.

| Scheme | Allocation | Description | Years of funding in the next spending review period |

|---|---|---|---|

| Boiler Upgrade Scheme | £1.545bn | Replacing fossil fuel heating systems | 2025/2026 – 2027/2028 |

| Heat Pump Investment Accelerator | £15m | Bringing forward investment in the UK heat pump manufacturing supply chain | 2025/2026 |

| New £400m energy efficiency grant | £400m | For households in England to make changes such as bigger radiators or better insulation | 2025/2026 – 2027/2028 |

| New local authority retrofit scheme | £500m | Supporting low-income and cold homes with measures such as insulation | 2025/2026 – 2027/2028 |

| Social Housing Decarbonisation Fund | £1.253bn | Supporting social homes to be insulated or retrofitted | 2025/2026 – 2027/2028 |

| Green Heat Network Fund[1] | £485m | Helping homes and buildings access low carbon, affordable heating | 2025/2026 – 2027/2028 |

| Heat Network Efficiency Scheme[1] | £45m | Improving around 100 existing heat networks | 2025/2026 – 2027/2028 |

| Public Sector Decarbonisation Scheme | £1.17bn | Providing grants for public sector bodies to fund heat decarbonisation and energy efficiency measures | 2025/2026 – 2027/2028 |

| Industrial Energy Transformation Fund | £225m | Continuing to help businesses transition to a low-carbon future | 2025/2026 – 2027/2028 |

| Industrial Energy Efficiency and decarbonisation support | £410m | Further details to be announced in due course | 2025/2026 – 2027/2028 |

Sustainability Acronyms & Abbreviations

BVCM – Beyond Value Chain Mitigation

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESOS – Energy Savings Opportunity Scheme

ESRS – European Sustainability Reporting Standards

FCA – Financial Conduct Authority

FfB – Finance for Biodiversity

GHG Protocol – Greenhouse Gas Protocol

GFANZ – Glasgow Financial Alliance for Net Zero

GRI – Global Reporting Initiative

GSSB – Global Sustainability Standards Board

IIGCC – Institutional Investors Group on Climate Change

IETA – International Emissions Trading Association

ISSB – International Sustainability Standards Board

MESOS – Manage your Energy Savings Opportunity Scheme

NFRD – Non-Financial Reporting Directive

SASB – Sustainability Accounting Standards Board

SBTi – Science-Based Targets Initiative

SDFR – Sustainable Finance Disclosure Regulation

TCFD – Taskforce for Climate Related Disclosure

TISFD – Taskforce on Inequality and Social-related Financial Disclosures

TPT – Transition Plan Taskforce

UK ETS – UK Emissions Trading Scheme

UK SDR – Sustainability Disclosure Requirements

UK SDS – Sustainability Disclosure Standards

US SEC – Securities and Exchange Commission

VCMI – Voluntary Carbon Markets Integrity Initiative