ESG Policies and Regulations Update August 2024

Keeping pace with net zero policies and regulation changes can pose a challenge. Our monthly updates are designed to provide you with the necessary support and guidance through the intricate landscape of ESG policies. We deliver the latest updates and significant developments concerning key sustainability frameworks, regulations, and standards from across the UK, EU, and US, and delve into further detail on what you need to know.

In this month’s edition, we explore the UK’s proposed legislation on ESG rating providers and the newly published ‘Interoperability Mapping’ guidance by the Global Reporting Initiative and the Taskforce on Nature-related Financial Disclosures. We also examine the SEC’s defence of its climate disclosure rule in court and the Integrity Council for the Voluntary Carbon Market’s decision to withhold the high-integrity Core Carbon Principles (CCP) label from eight renewable energy methodologies.

Help us shape Acclaro’s ESG Updates!

Acclaro invites all readers to participate in a short 5-minute survey about our monthly ESG policy and regulation update. Your feedback will be used to enhance our update, so it can better meet your needs and effectively support your understanding and navigation of ESG updates.

The survey will remain open until the end of September.

August update

| Framework | Update |

|---|---|

| EU Legislation | CSDDD entered into force. The European Commission published FAQs on implementing the Corporate Sustainability Reporting Directive (CSRD). |

| UK Legislation | ESG rating agencies to be regulated in the UK. ESOS Action Plans and Annual Progress Updates. |

| International Reporting Standards | The Global Reporting Initiative and the Taskforce on Nature-related Financial Disclosures publish an ‘Interoperability Mapping’ guidance document. IASB propose illustrative examples to improve the reporting of climate-related impact and uncertainties in financial statements. |

| Financial Disclosure Frameworks | ESMA announces application date for fund-naming rules. |

| Voluntary Disclosure Framework | The Integrity Council for the Voluntary Carbon Market (ICVCM) announces 8 renewable energy methodologies will not receive the high integrity Core Carbon Principles (CCP) label. CDP Scoring Submission deadline extended. The SBTi release its Building Sector Science-Based Target-Setting Criteria. |

Subscribe to newsletter

Receive our regulatory updates along with relevant news and insights in our monthly newsletters

Key Insights

EU Legislation

The European Commission published FAQs on implementing the Corporate Sustainability Reporting Directive (CSRD).

The European Commission has released a list of FAQs to facilitate companies’ compliance with the legislation and ensure the usability and comparability of sustainability information reported.

The publication also includes information regarding timelines and the scope and application of the European Sustainability Reporting Standards (ESRS).

The FAQs cover the following topics:

- The ESRS’ scope and corresponding application dates.

- Possible exemptions from reporting requirements.

- Assurance considerations.

- Information on the first set of ESRS.

- Digital tagging requirements.

For those companies required to comply with the CSRD, the FAQs provide a useful starting point for gaining more insight and clarification about its implementation.

UK Legislation

ESG rating agencies to be regulated in the UK

The UK Government plans to introduce new legislation in 2025, regulating ESG rating providers. Overseen by the Financial Conduct Authority (FCA), this legislation will provide more transparency on the data and methodologies providers use as well as require providers to disclose potential conflicts of interest.

The new planned law follows increasing demand from investors to integrate ESG consideration into the investment process. Currently, the processes and activities undertaken by providers are not covered by markets and securities regulators.

In 2021, IOSCO, a securities regulator standards setter, requested regulators to focus on improving transparency in the ESG ratings and to begin regulatory oversight. IOSCO also published a list of recommendations for regulators outlining requirements for providers to disclose potential conflicts of interest and the data and methodologies used.

Since IOSCO’s publication, some jurisdictions have increased their regulatory oversight in ESG ratings. For example, the EU recently agreed to bring ESG ratings under the authority of the European markets regulator, ESMA and to introduce rules to increase the reliability and comparability of ESG ratings and prevent providers’ conflict of interest.

The new regulation in the UK follows suit with the EU and aims to align with IOSCO’s recommendations.

ESOS Action Plans and Annual Progress Updates

The 6th August marked a milestone for ESOS submissions. At Acclaro, we delivered over 34 ESOS submissions on time for our clients. Not only is this process about compliance but providing valuable and actionable insights for decarbonisation plans going forward. Now that submissions are over, Acclaro would like to take the opportunity to thank everyone for their support during the process, it was very much a team effort!

However, ESOS requirements don’t stop here. During Phase 3, it was announced that organisations must also submit Energy Action Plans and annual Progress Updates based on their energy-saving initiatives. These Energy Action Plans detail how organisations intend to enhance energy efficiency and reduce carbon emissions. The plan must include estimated kWh savings for all proposed energy-saving projects and a timeline outlining when and how these projects will be implemented.

In addition to the Action Plan, companies are required to submit an Annual Progress Update. This update serves as a transparent way to communicate their sustainability achievements. The ESOS Progress Report must list all the energy-saving actions the company has implemented over the past year as well as any actions that were not successfully carried out. It should also provide an estimate of total energy savings achieved and indicate whether these savings align with the timelines set out in the ESOS Action Plan.

The deadline for submitting the ESOS Action Plan is the 5th December 2024. However, due to a delay in the availability of the MESOS digital service and the functionality to submit an Action Plan, The Environment Agency and Regulators for the Devolved Administrations have extended the submission deadline to the 5th March 2025. Detailed requirements for the Action Plan are already outlined in legislation and ESOS guidance, with further information expected by 1st November 2024.

Need help preparing and submitting your ESOS Action Plan? We’re here to support you.

International Reporting Standards

The Global Reporting Initiative and the Taskforce on Nature-related Financial Disclosures publish an ‘Interoperability Mapping’ guidance document

The GRI and TNFD have worked closely together over the past two years to support the development of each other’s guidance documents. The GRI Standards establish best practices for sustainability reporting whilst the TNFD provides a framework that guides organisations on their assessment, disclosure and actions on their nature-related dependencies, impacts, risks and opportunities.

The guidance document aims to support GRI’s reporters align with the TNFD Recommendations and help TNFD users incorporate sustainability reporting following the GRI Standards.

The interoperability mapping highlights the high level of alignment between the TNFD Recommendations and metrics and the GRI Standards reporting requirements and metrics.

The key alignment outcomes highlighted by the TNFD include:

- The use of consistent nature-related concepts and definitions.

- GRI’s materiality approach addressing impact is referenced and incorporated in the TNFD Recommendations and guidance.

- All disclosures in GRI 101: Biodiversity 2024 are reflected in the TNFD Recommendations.

- The TNFD core global disclosure metrics are closely aligned with the related metrics in the GRI Standards.

- The TNFD LEAP approach (which helps organisations identify and assess nature-related issues) is referenced in GRI 101.

- GRI 101 uses TNFD’s definitions and criteria when determining an organisation’s location in or near ecologically sensitive areas.

This guidance will be valuable to those companies that report under GRI Standards and utilise the TNFD framework as consistencies between the two bodies will streamline sustainability reporting.

IASB propose illustrative examples to improve the reporting of climate-related impact and uncertainties in financial statements

With consultations launched last week, the International Accounting Standards Board (IASB) has proposed guidance to help companies improve the reporting of climate impacts and uncertainties in their financial statements. The consultation and proposed guidance respond to raised concerns by investors about the limited information disclosed on climate-related uncertainties in financial statements and its inconsistency with information provided outside the financial statements.

The IASB has proposed eight illustrative examples of how companies should apply International Financial Reporting Standards (IFRS) when reporting the effects of climate and environmental uncertainties in financial statements. These examples aim to improve the transparency of disclosed information in financial statements and the alignment between financial statements and other areas of a company’s reporting.

The illustrative examples focus on areas such as materiality judgements, disclosures about assumptions and estimation uncertainties and disaggregation of information. According to the IASB, these requirements outlined in proposed examples, can also be applied to other types of uncertainties beyond climate-related matters.

IASB worked closely with the International Sustainability Standards Board (ISSB) to ensure the illustrative examples aligned with the ISSB’s sustainability-related disclosure requirements.

Although the illustrative examples do not add or change the requirements in the IFRS Accounting Standards, those companies that adhere to these standards should utilise these examples as a framework to improve the consistency of information disclosed in financial statements. This will provide investors with more comprehensive information on climate risks and uncertainties.

The IASB is welcoming feedback from stakeholders up until the 28th November 2024. Following the review, the IASB will determine whether to proceed with the proposed illustrative examples to support the IFRS Accounting Standards. In addition to the illustrative examples, the IASB will develop additional actions to help improve the reporting in financial statements. Companies are advised to stay informed and up to date with IASB announcements.

Financial Disclosure Frameworks

ESMA announces application date for fund-naming rules

On 14th May 2024, ESMA, the EU’s securities regulator, published “Guidelines on funds’ names using ESG or sustainability-related terms“. This document outlined the minimum sustainability requirements EU fund managers and managers of funds marketed into the EU must adhere to when using sustainability terms. The Guidelines also require funds to introduce exclusion screens in line with the EU Paris-aligned and Climate transition Benchmarks.

On 21st August 2024, ESMA published translations of the Guidelines in all EU languages. Consequently, the Guidelines will apply to new funds from the 21st November 2024, with existing funds having until the 21st May 2025 to comply.

Fund managers should familiarise themselves with the minimum requirements outlined in the Guidelines.

U.S Climate Rule

The US Securities and Exchange Commission defends its Climate Disclosure rule in court

The US Securities and Exchange Commission (SEC) defends its new climate reporting rule in court, after the rule’s implementation paused in April, arguing that the proposed disclosures provide “information directly relevant to the value of the investments” and that it is within the Commission’s authority to mandate climate risk disclosures.

The SEC released its new climate reporting rule in early March. The reporting rule aims to establish requirements for U.S. public companies to disclose the climate risks facing their businesses, their plans to address those risks and the financial impact of severe weather events and, for some organisations, greenhouse gas emissions from their operations.

Following the release of SEC’s new rule, a series of legal challenges followed with 9 court petitions filed within 10 days and a lawsuit against the rule filed by 25 Republican state attorneys. Arguments against the rule include onerous and expensive requirements for companies to follow, the information it requests, such as GHG emissions data, being unreliable and the rule exceeding the SEC’s authority.

The SEC (Securities and Exchange Commission) emphasises in its filings that climate-related risks, along with how companies respond to these risks, can have a significant impact on a company’s financial performance. However, the current reporting standards for these risks are inconsistent and lack comparability, which hampers investors’ ability to make well-informed decisions. To address this, the SEC argues for the need for more detailed and consistent disclosure of climate-related information. The Commission also points out that Congress has given it the authority to mandate such disclosures to support investors in their investment and voting decisions.

The politicisation between investment firms and ESG disclosure rules has made it difficult to predict and plan for the implementation of the SEC reporting rule. Successful legal challenges against the SEC may prompt large debates amongst asset managers about compliance, which could negatively affect the rulemaking efforts and outcomes.

Voluntary Disclosure Framework

The Integrity Council for the Voluntary Carbon Market (ICVCM) announces 8 renewable energy methodologies will not receive high integrity Core Carbon Principles (CCP) label

The Governing Board of ICVCM have confirmed that carbon credits issued under eight renewable energy methodologies will not receive a high-integrity CCP label.

The ICVCM was formed in 2021 and developed a set of 10 principles known as the Core Carbon Principles (CCP) that define the requirements a carbon offsetting project must adhere to, to be classed as high integrity. Earlier this year, the CCP label was developed. Carbon crediting programs and methodologies are assessed as part of a science-based ‘two-tick’ assessment process. The label enables corporate buyers to distinguish between high-quality and ‘phantom’ carbon credits. Those credits with a CCP label are regarded as high-quality. The CCP label aims to restore corporate buyers’ trust in the Voluntary Carbon Market (VCM) and guarantee that the carbon credits labelled as high integrity deliver genuine and accurate emission reductions and environmental and social benefits.

The ICVCM states the rejection of eight renewable energy methodologies, affects approximately 236 million unretired credits (approximately 32% of the VCM). These methodologies failed to meet the Integrity Council’s requirement for additionality (where a project’s emissions reductions or removals would not have happened without the revenue from the sale of carbon credits). The Integrity Council explains that although renewable energy is essential for global decarbonisation, many renewable projects would proceed without the financial incentive of carbon credits.

The ICVCM is continuing to assess carbon crediting programs alongside methodologies. For those companies considering utilising carbon crediting, it is necessary to stay informed with ICVCM updates and what credits receive a high-integrity CCP label.

CDP Scoring Submission deadline extended

The CDP scoring submission deadline has been extended from the 18th September to the 2nd October 2024 after the new portal faced a series of technical issues.

CDP provides a disclosure and scoring system on climate, forests and water security, with more than 21,000 companies reporting environmental data through CDP each year. This year, along with several updates, CDP introduced a new portal to facilitate disclosures, however, users have found the portal difficult to navigate and experienced numerous technical difficulties.

CDP is working with the portal developer to address these issues, with some fixes already complete and others to be completed throughout August.

CDP has reassured companies that these technological issues will not impact scoring, nor will companies be penalised because of these issues.

Although an extension has been granted, companies completing CDP this year should still aim for an early successful submission by continuing to collect high-quality data, engaging with colleagues internally, and aligning responses with sustainability goals.

The SBTi release its Building Sector Science-Based Target-Setting Criteria

The Science Based Targets initiative has published its Building Sector Science-Based Target-Setting Criteria, offering an innovative decarbonisation framework for companies and financial institutions in the buildings value chain to set 1.5ºC-aligned emissions reduction targets.

This framework was developed with input from an independent Expert Advisory Group (EAG) which included representatives from companies, financial institutions, non-profit and multilateral organisations. The process also involved a two-month public consultation and four-month pilot test.

The criteria focus on four key areas:

- Stop fossil fuel installations: Companies must commit to stopping the installation of fossil fuel-based systems for heating, cooking, power generation and hot water by 2030.

- Reduce in-use operational emissions:These emissions are tied to a building’s energy use. SBTi worked with the Carbon Risk Real Estate Monitor (CRREM) to create regional pathways for reducing these emissions, enabling differences in local energy grids and building usage to be considered.

- Reduce upfront embodied emissions: With global floor area set to grow by approximately 15% by 2030, 80% of which will be in developing countries, the criteria call for setting targets to reduce embodied emissions i.e. those from raw materials, manufacturing, transportation and construction processes.

- Retrofit inefficient buildings: Since 80% of today’s buildings will still be in use by 2050, retrofitting rates must be more than double by 2030 to meet the International Energy Agency’s (IEA) Net Zero by 2050 Scenario. SBTi encourages companies to prioritise energy efficiency upgrades to decarbonise older buildings.

For those companies subject to these criteria and looking for more information, the SBTi will hold two global webinars on the 17th October to provide further details on the criteria and answer any questions.

- Register for Session 1: 10:00 am (CET) / 4:00 pm (HKT)

- Register for Session 2: 10:00 am (ET) / 4:00 pm (CET)

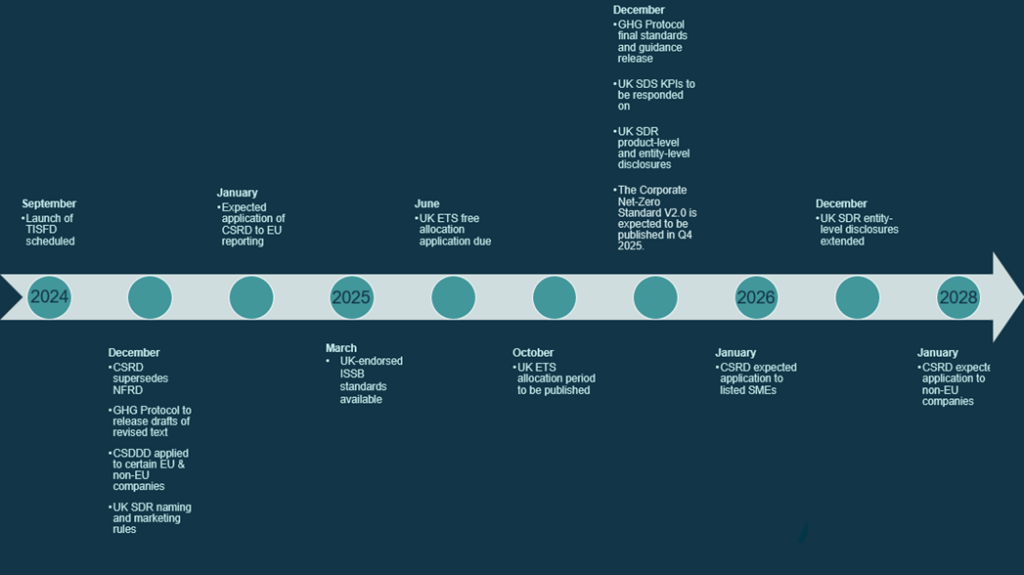

Horizon Scanning

| Date expected | Framework | Description |

|---|---|---|

| September 2024 | TISFD | Launch of TISFD scheduled. |

| October 2024 | CDP | Scoring Submission Deadline |

| November 2024 | – | ESMA sustainability find-naming rules come into effect for new funds |

| December 2024 | UK SDR | Naming and marketing rules come into force, with accompanying disclosures, from 2 December |

| 2024 | ESRS | Anticipated adoption of the second draft of ESRS |

| 2024 | CSRD | Due to supersede NFRD in 2024. Large companies already subject to NFRD must begin reporting on the fiscal year 2024. Drafting of sectoral-ESRS. |

| 2024 | CSDDD | Application of CSDDD to certain EU and non-EU companies expected to begin at some stage in 2024 |

| 2024 | GHG Protocol | Expected to release drafts of revised text |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| June 2025 | UK ETS | The window for operators of installations to apply for free allocation, or to be in the schemes for hospital or small emitters or for ultra-small emitters, in the 2026-2030 allocation period is 1 April – 30 June 2025. |

| October 2025 | UK ETS | Hospitals or small emitters and ultra-small emitters for the 2026-2030 allocation period must be published by 17 October 2025 |

| December 2025 | UK SDR | Ongoing product-level and entity-level disclosures for firms with AUM>£50bn, from 2 December |

| December 2025 | SBTi | The Corporate Net-Zero Standard V2.0 is expected to be published in Q4 2025. |

| March 2025 | UK SDR | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SRS |

| March 2025 | ESOS | ESOS Action Plan submission deadline. |

| May 2025 | – | ESMA sustainability find-naming rules come into effect for existing funds. |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| February 2026 | UK ETS | Date before which the allocation table for the 2026-2030 allocation period must be published is 28 February 2026 |

| June 2026 | CSRD | Sector-specific standards to be published under the EU CSRD. |

| December 2026 | UK SDR | Entity-level disclosure rules extended to firms with AUM>£5bn, from 2 December |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

Funding

In its Autumn Statement 2022, the UK Government announced a new, long-term commitment to enhance energy efficiency, aiming to drive down costs for households, businesses, and the public sector with the end goal being a 15% reduction in the UK’s final energy consumption from buildings and industry by 2030 compared to 2021 levels.

This commitment took the form of new government funding worth £6 billion being made available from 2025 to 2028. These funds have recently been earmarked, in a government press statement on December 18, 2023, for various schemes aimed at delivering energy efficiency assistance to businesses and homes throughout the United Kingdom. Some of these schemes are new, while some are existing schemes that have been allocated more funding.

| Scheme | Allocation | Description | Years of funding in the next spending review period |

|---|---|---|---|

| Boiler Upgrade Scheme | £1.545bn | Replacing fossil fuel heating systems | 2025/2026 – 2027/2028 |

| Heat Pump Investment Accelerator | £15m | Bringing forward investment in the UK heat pump manufacturing supply chain | 2025/2026 |

| New £400m energy efficiency grant | £400m | For households in England to make changes such as bigger radiators or better insulation | 2025/2026 – 2027/2028 |

| New local authority retrofit scheme | £500m | Supporting low-income and cold homes with measures such as insulation | 2025/2026 – 2027/2028 |

| Social Housing Decarbonisation Fund | £1.253bn | Supporting social homes to be insulated or retrofitted | 2025/2026 – 2027/2028 |

| Green Heat Network Fund[1] | £485m | Helping homes and buildings access low carbon, affordable heating | 2025/2026 – 2027/2028 |

| Heat Network Efficiency Scheme[1] | £45m | Improving around 100 existing heat networks | 2025/2026 – 2027/2028 |

| Public Sector Decarbonisation Scheme | £1.17bn | Providing grants for public sector bodies to fund heat decarbonisation and energy efficiency measures | 2025/2026 – 2027/2028 |

| Industrial Energy Transformation Fund | £225m | Continuing to help businesses transition to a low-carbon future | 2025/2026 – 2027/2028 |

| Industrial Energy Efficiency and decarbonisation support | £410m | Further details to be announced in due course | 2025/2026 – 2027/2028 |

Sustainability Acronyms & Abbreviations

BVCM – Beyond Value Chain Mitigation

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESOS – Energy Savings Opportunity Scheme

ESRS – European Sustainability Reporting Standards

FCA – Financial Conduct Authority

FfB – Finance for Biodiversity

GHG Protocol – Greenhouse Gas Protocol

GFANZ – Glasgow Financial Alliance for Net Zero

GRI – Global Reporting Initiative

GSSB – Global Sustainability Standards Board

IIGCC – Institutional Investors Group on Climate Change

IETA – International Emissions Trading Association

ISSB – International Sustainability Standards Board

MESOS – Manage your Energy Savings Opportunity Scheme

NFRD – Non-Financial Reporting Directive

PAAO – Paris Aligned Asset Owners

SASB – Sustainability Accounting Standards Board

SBTi – Science-Based Targets Initiative

SDFR – Sustainable Finance Disclosure Regulation

TCFD – Taskforce for Climate Related Disclosure

TISFD – Taskforce on Inequality and Social-related Financial Disclosures

TPT – Transition Plan Taskforce

UK ETS – UK Emissions Trading Scheme

UK SDR – Sustainability Disclosure Requirements

UK SDS – Sustainability Disclosure Standards

US SEC – Securities and Exchange Commission

VCMI – Voluntary Carbon Markets Integrity Initiative