ESG Policies and Regulations Update April 2024

Keeping pace with net zero policies and regulation changes can pose a challenge. Our monthly updates are designed to provide you with the necessary support and guidance through the intricate landscape of ESG policies. We deliver the latest updates and significant developments concerning key sustainability frameworks, regulations, and standards from across the UK, EU, and US, and delve into further detail on what you need to know.

In this month’s edition, we delve into the publication of the UK’s Transition Plan Taskforce’s final suite of climate transition plan resources, the Science-Based Target initiative’s announcement to expand the utilisation of environmental attribute certificates for Scope 3 abatement, and the European Parliament’s recent vote to adopt the Corporate Sustainability Due Diligence Directive.

April update

| Framework | Update |

|---|---|

| International Standards | ISSB has commenced research projects focused on risks and opportunities related to nature and human capital to enhance current disclosures. ISSB has released the IFRS Sustainability Disclosure Taxonomy, enabling investors to analyse sustainability-related financial disclosures efficiently. |

| UK Energy Audits | The Energy Savings and Opportunity Scheme (ESOS) has updated its reporting system – MESOS. |

| UK anti-greenwashing rule | The UK FCA has published updates on the anti-greenwashing rule, the Sustainability Disclosure Requirements (SDR) and the labelling framework. |

| EU Due Diligence | The European Parliament has approved the Corporate Sustainability Due Diligence Directive (CSDDD). |

| US Climate Rule | The Securities and Exchange Commission (SEC) has paused its new climate disclosure rule in response to legal challenges. |

| Net-Zero frameworks | The SBTi has expanded its role for carbon credits in Net Zero Targets. IETA has unveiled new Guidelines for High Integrity Use of Carbon credits. |

| Transition Plans | The Transition Plan Taskforce (TPT) has released new resources to aid businesses in accessing finance for achieving net-zero emissions. |

Key Insights

International Standards

International Sustainability Standards Board (ISSB) research projects

The ISSB is a comprehensive global baseline for high-quality Sustainability Disclosure Standards to meet investor demands for transparent, reliable, sustainability reporting and will contribute to addressing greenwash.

The ISSB has announced the initiation of research projects focused on investigating the risks and opportunities associated with nature, focusing on biodiversity, ecosystems, and ecosystem services, as well as human capital.

These projects will build on relevant existing initiatives, such as the SASB, Climate Disclosure Board guidance, and TNFD. These projects aim to enhance disclosures in the mentioned topic areas by evaluating the current limitations of disclosures, proposing potential solutions, and identifying the common information needs of investors. These efforts will facilitate investors’ understanding of how these risks and opportunities could impact a company’s operations.

The ISSB is dedicated to developing its own standards in these critical areas where more specific disclosures are necessary to establish a global baseline of sustainability-related financial disclosures.

The ISSB will unveil its work plan for the next two years in June 2024.

ISSB Sustainability Disclosure Taxonomy

The ISSB has released the IFRS Sustainability Disclosure Taxonomy (ISSB Taxonomy), facilitating the efficient analysis of sustainability-related financial disclosures by investors and capital providers. Its adoption by companies will enable investors to readily search, extract, and compare sustainability-related financial disclosures, as a global baseline of standards is established under ISSB.

Reflecting both IFRS 1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS 2 (Climate-related Disclosures) and their accompanying guidance, the taxonomy aims to foster dialogue between companies and investors.

Importantly, it does not introduce new requirements or impact a company’s compliance with standards but rather enables consistent tagging of information prepared using ISSB standards. Designed to align with the IFRS Accounting Taxonomy, this digital tool facilitates the provision of a comprehensive reporting package to investors and can also be compatible with other digital taxonomies.

UK Energy Audits

Energy Savings Opportunity Scheme (ESOS)

Manage your Energy Savings Opportunity Scheme (MESOS), the new reporting system associated with ESOS, officially launched on the 19th March. MESOS is being introduced in two phases. Participants can now register their Phase 3 user and organisational accounts in the initial phase. The second phase, scheduled for completion by the end of April, will allow participants to finalise and submit their compliance notifications.

In light of the introduction of this new IT system and its two-phase compliance notification process, the Environment Agency has extended the deadline for compliance notification submission. The updated requirements are as follows:

- Companies are required to register their user and organisational accounts in MESOS by the 5th June 2024.

- Companies must submit their compliance notifications by the 6th August 2024.

Failure to meet these deadlines may result in enforcement action. If companies anticipate challenges in meeting these deadlines, it is advisable to notify the Environment Agency in advance.

UK Anti-Greenwashing Rule

UK Financial Conduct Authority (FCA)

The Financial Conduct Authority (FCA) has released Finalised Guidance (FG24/3) relating to its Sustainability Disclosure Requirements (SDR) and pertaining to the Anti-Greenwashing regulation, coinciding with its implementation scheduled for the 31st of May. This regulation mandates that firms ensure any mention of a product or service’s sustainability attributes accurately portrays said attributes and is communicated in a fair, transparent, and non-misleading manner. The objective of this guidance is to assist firms in comprehending the FCA’s expectations regarding ESG 4.31R. It revolves around four fundamental principles:

- Sustainability reference must be precise and substantiable.

- Sustainability reference should be transparent and conveyed in an understandable manner.

- Sustainability reference must be comprehensive, avoiding the omissions or concealment of pertinent information.

- Comparisons should be fair and meaningful.

Moreover, the FCA has issued a consultation paper (CP24/8) outlining its plan to expand the Sustainability Disclosure Requirements (SDR) and investment labelling framework, which will apply to asset management firms starting May 31, 2024, to encompass all types of portfolio management services. Since the SDR and labelling framework are primarily designed to benefit retail investors, the proposed expansion targets wealth management services catering to individuals and model portfolios for retail investors. However, firms providing portfolio management services to professional clients have the option to participate in the labelling framework.

EU Due Diligence

Corporate Sustainability Due Diligence Directive (CSDDD)

On the 24th April, the European Parliament approved the CSDDD, thereby advancing it a significant step closer to formal adoption within the EU.

The proposed EU CSDDD aims to enforce regulatory requirements for large companies to undertake environmental and human rights due diligence measures within their operations and across their global supply chains. Following the CSDDD, large companies are defined as those with more than 1000 employees on average and a turnover surpassing €450 million.

The CSDDD will be implemented incrementally over 5 years. For example, companies with more than 5000 employees and a turnover of €1,500 million will face initial compliance requirements in 2027 while those with 3000 employees and a turnover of €900 million will be affected in 2028.

After the European Parliament’s endorsement, the final decision will rest with the Competitiveness Council, known as COMPET, with proceedings anticipated to unfold in late May. Upon adoption in the EU, member states will have two years to implement the directive into national legislation.

US Climate Rule

US Securities and Exchange Commission (SEC) Climate Disclosure Rule

The US Securities and Exchange Commission has reportedly paused the implementation of its recently unveiled climate disclosure rule, as it prepares to address legal challenges in court.

This decision comes in response to strong criticism from various business and trade organisations, who argue that the SEC has exceeded its regulatory jurisdiction. The regulation will remain in abeyance to mitigate potential regulatory uncertainty, while the U.S. Court of Appeals for the Eighth Circuit adjudicates the challenges.

Net Zero Frameworks

Science-Based Targets initiative (SBTi)

Following SBTi’s announcement in January 2024, outlining its plans to update its Corporate Net-Zero Standard this year with a focus on addressing Scope 3 emissions, SBTi has now announced its plan to expand the use of environmental attribute certificates for Scope 3 abatement.

Environmental attribute certificates, as defined by SBTi, are tools used to quantify and track the environmental benefits of different goods, activities, or projects, including emissions reduction credits (commonly referred to as carbon offsetting) and energy attribute certificates.

This new guidance gives companies more options for tackling emissions and reaching net-zero goals, which in turn can help unlock funding for climate-related projects. Following this announcement, SBTi will consult with other relevant groups and stakeholders to refine guidelines, including how to responsibly use environmental attribute certificates in setting targets. SBTi has also clarified they won’t be validating carbon credits, leaving that responsibility to others.

SBTi aims to release a first draft of detailed guidance on using environmental attribute certificates for Scope 3 emissions reduction by July 2024.

International Emissions Trading Association (IETA)

Following the recent announcement by SBTi, the IETA has unveiled new guidelines aimed at facilitating integrity-driven procurement of carbon credits by corporate entities striving to achieve their net-zero goals. These guidelines are designed to provide corporate buyers with clear, unambiguous, and robust guidance on maintaining integrity throughout the carbon credit procurement process.

The report outlines 6 guidelines designed to support companies contemplating the adoption of carbon credits. The guidelines recommend that corporations publicly demonstrate their support for the Paris Agreement and establish clear net-zero pathways, ensuring that carbon credits facilitate high-integrity net-zero strategies. Additionally, they underscore the importance of aligning the use of carbon credits with the mitigation hierarchy, prioritising emission reductions at the source before resorting to carbon offsets for unabated emissions. Guidelines five and six emphasise the procurement of exclusively high-quality carbon credits and advocate for transparent disclosure regarding their utilisation.

Transition Plans

Transition Plan taskforce (TPT)

Established by HM Treasury in March 2022, the Transition Plan Taskforce (TPT) is dedicated to formulating best practices for transition plan disclosures in finance and the real economy. It collaborates with international governments and regulatory networks to promote common baselines and principles, fostering effective transition planning on a global scale.

TPT unveiled its final suite of transition plan resources to better support businesses access finance for achieving net zero emissions. These resources aim to facilitate the development of consistent and globally comparable company reports, while reducing the complexity of disclosures.

TPT’s released resources offer sector-specific transition plan guidance tailored for various industries, including Asset Owners, Asset Managers, Banks, Electric Utilities & Power Generators, Food & Beverage, Metals & Mining, and Oil & Gas. These resources provide concise sector summaries and high-level guidance for 30 sectors of the global economy, alongside advice on conducting a transition planning cycle.

Additionally, the newly released materials delve into the opportunities and challenges of transition plans in emerging markets and developing economies. They also include independent advisory pieces from TPT Working Groups on Adaptation, Nature, JustTransition, and SMEs, examining how transition planning can extend beyond realising net zero.

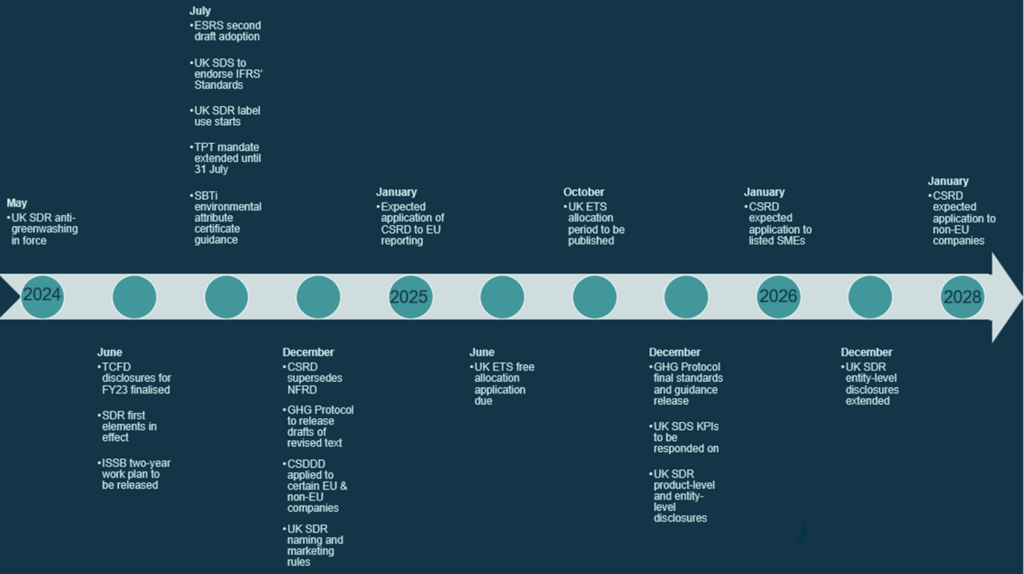

Horizon Scanning

| Date expected | Framework | Description |

|---|---|---|

| May 2024 | UK SDR | Anti-greenwashing rule and labelling framework expansion comes into force on 31 May |

| June 2024 | TCFD | FCA ESG Rules: TCFD disclosures relating to Financial Year 2023 to be finalised |

| June 2024 | UK SDR | First elements of the new rules (excluding anti-greenwashing rule) to come into force – at the earliest |

| June 2024 | ISSB | Two-year work plan release expected |

| July 2024 | ESRS | Anticipated adoption of the second draft of ESRS |

| July 2024 | UK SDS | Secretary of State for Business and Trade will consider the endorsement of the IFRS Sustainability Disclosure Standards, to create the UK SDS |

| July 2024 | UK SDR | Firms can begin to use labels, with accompanying disclosures from 31 July |

| July 2024 | TPT | TPT’s mandate extended until at least 31 July, in order to support the Transition Finance Market Review. |

| July 2024 | SBTi | First draft of detailed guidance on using environmental attribute certificates for Scope 3 emissions reduction |

| December 2024 | UK SDR | Naming and marketing rules come into force, with accompanying disclosures, from 2 December |

| 2024 | CSRD | Due to supersede NFRD in 2024. Large companies already subject to NFRD must begin reporting on the fiscal year 2024. Drafting of sectoral-ESRS. |

| 2024 | CSDDD | Application of CSDDD to certain EU and non-EU companies expected to begin at some stage in 2024 |

| 2024 | GHG Protocol | Expected to release drafts of revised text |

| January 2025 | CSRD | Expected application of CSRD to large EU reporting. Sustainability reporting in 2026 for Financial Year 2025 |

| June 2025 | UK ETS | The window for operators of installations to apply for free allocation, or to be in the schemes for hospital or small emitters or for ultra-small emitters, in the 2026-2030 allocation period is 1 April – 30 June 2025. |

| October 2025 | UK ETS | Hospitals or small emitters and ultra-small emitters for the 2026-2030 allocation period must be published by 17 October 2025 |

| December 2025 | UK SDR | Ongoing product-level and entity-level disclosures for firms with AUM>£50bn, from 2 December |

| 2025 | GHG Protocol | Final standards and guidance to be released |

| 2025 | UK SDS | Suite of KPIs will need to responded on from 2025 onwards |

| January 2026 | CSRD | Expected application of EU CSRD to listed SMEs (may affect a small number of portfolio companies) |

| February 2026 | UK ETS | Date before which the allocation table for the 2026-2030 allocation period must be published is 28 February 2026 |

| December 2026 | UK SDR | Entity-level disclosure rules extended to firms with AUM>£5bn, from 2 December |

| January 2028 | CSRD | Expected application of EU CSRD to non-EU companies, reporting in 2029 for Financial Year 2028 |

Funding

In its Autumn Statement 2022, the UK Government announced a new, long-term commitment to enhance energy efficiency, aiming to drive down costs for households, businesses, and the public sector with the end goal being a 15% reduction in the UK’s final energy consumption from buildings and industry by 2030 compared to 2021 levels.

This commitment took the form of new government funding worth £6 billion being made available from 2025 to 2028. These funds have recently been earmarked, in a government press statement on December 18, 2023, for various schemes aimed at delivering energy efficiency assistance to businesses and homes throughout the United Kingdom. Some of these schemes are new, while some are existing schemes that have been allocated more funding.

| Scheme | Allocation | Description | Years of funding in the next spending review period |

|---|---|---|---|

| Boiler Upgrade Scheme | £1.545bn | Replacing fossil fuel heating systems | 2025/2026 – 2027/2028 |

| Heat Pump Investment Accelerator | £15m | Bringing forward investment in the UK heat pump manufacturing supply chain | 2025/2026 |

| New £400m energy efficiency grant | £400m | For households in England to make changes such as bigger radiators or better insulation | 2025/2026 – 2027/2028 |

| New local authority retrofit scheme | £500m | Supporting low-income and cold homes with measures such as insulation | 2025/2026 – 2027/2028 |

| Social Housing Decarbonisation Fund | £1.253bn | Supporting social homes to be insulated or retrofitted | 2025/2026 – 2027/2028 |

| Green Heat Network Fund[1] | £485m | Helping homes and buildings access low carbon, affordable heating | 2025/2026 – 2027/2028 |

| Heat Network Efficiency Scheme1 | £45m | Improving around 100 existing heat networks | 2025/2026 – 2027/2028 |

| Public Sector Decarbonisation Scheme | £1.17bn | Providing grants for public sector bodies to fund heat decarbonisation and energy efficiency measures | 2025/2026 – 2027/2028 |

| Industrial Energy Transformation Fund | £225m | Continuing to help businesses transition to a low-carbon future | 2025/2026 – 2027/2028 |

| Industrial Energy Efficiency and decarbonisation support | £410m | Further details to be announced in due course | 2025/2026 – 2027/2028 |

Sustainability Acronyms & Abbreviations

CSDDD – Corporate Sustainability Due Diligence Directive

CSRD – Corporate Sustainability Reporting Directive

ESOS – Energy Savings Opportunity Scheme

ESRS – European Sustainability Reporting Standards

FCA – Financial Conduct Authority

GHG Protocol – Greenhouse Gas Protocol

GRI – Global Reporting Initiative

IETA – International Emissions Trading Association

ISSB – International Sustainability Standards Board

MESOS – Manage your Energy Savings Opportunity Scheme

SBTi – Science-Based Targets Initiative

TCFD – Taskforce for Climate Related Disclosure

TPT – Transition Plan Taskforce

UK ETS – UK Emissions Trading Scheme

UK SDR – Sustainability Disclosure Requirements

UK SDS – Sustainability Disclosure Standards

US SEC – Securities and Exchange Commission